It’s remarkable how often cities insist they “don’t have a startup problem, they have a funding problem,” as if investors are the villains refusing to fuel their brilliant founders.

In this session, Jonathan Greechan, Co-Founder and CEO of the Founder Institute, systematically dismantles that misunderstanding in a meaningful direction that guides economic development offices to better serve both entrepreneurs and the role of investors in startups.

Sixteen years of data across thousands of cohorts and 200,000+ entrepreneurial assessments point to a simple truth: most regions don’t lack capital, they lack capacity. And capacity isn’t built by ribbon-cutting innovation districts or trophy venture funds; it’s built by people, habits, and bottom-up infrastructure.

During a webinar enclosed below, Jonathan’s tracks closely with what Brookings, Kauffman, and OECD research has been arguing for years: new businesses drive almost all net job creation and a disproportionate share of innovation.

In fact, as the Kauffman Foundation has documented that Companies less than five years old create nearly all net new jobs in the United States. Greechan pushes this further, citing data that a 1 percent increase in entrepreneurial activity correlates with a 2 percent decrease in poverty; a point also supported by research from MIT’s Scott Stern on entrepreneurship and regional inequality.

What emerges from the Founder Institute’s worldwide work is a three-part model that stands in stark contrast to traditional top-down economic development: activate entrepreneurial talent, empower it with structure and mentorship, and ignite a local funding ecosystem instead of waiting for outside investors to magically appear.

Let me share the webinar so you can tune in before we go on with some thoughts...

The Five-Step Rule and the Myth of the Funding Problem

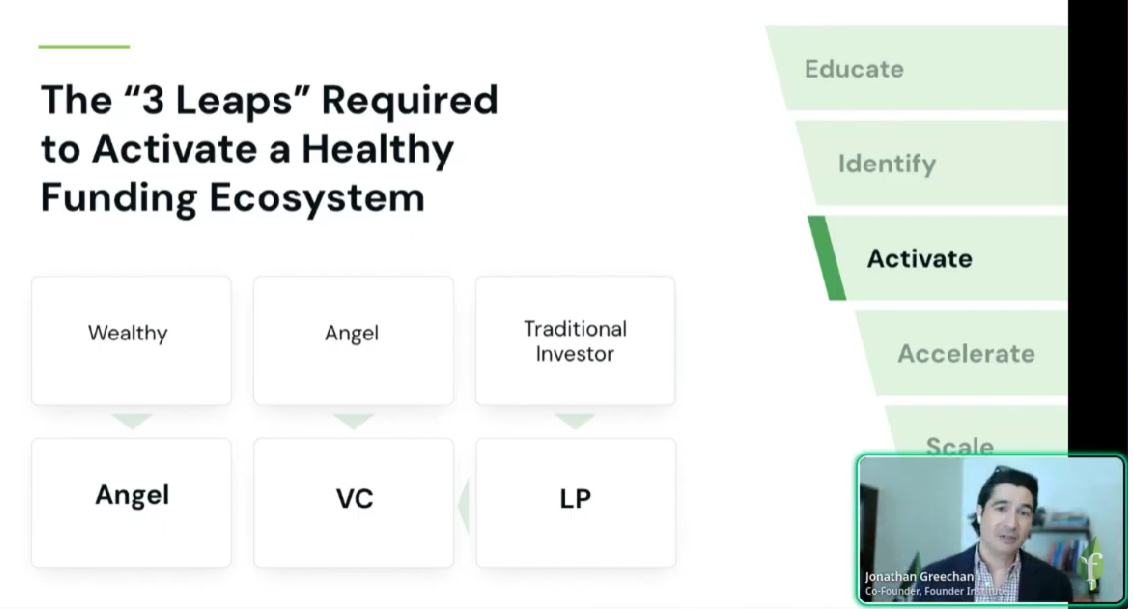

Much of the webinar centers on what FI calls the ecosystem activation rule: Educate → Identify → Activate → Accelerate → Scale. This bottom-up pipeline treats founders the way agriculture treats soil: if you don’t cultivate it, the farm collapses no matter how shiny your tractors are. Greechan argues that cities that rush to create seed funds or matching programs without first developing early-stage entrepreneurial capability end up producing “false positives” startups whose traction metrics don’t justify the funding they've received. This isn’t just a waste; it chases away the very Series A investors cities claim to want.

This pattern echoes OECD warnings about “innovation theater,” where ambitious but misaligned programs inflate expectations without improving economic outcomes. It also parallels the critique in The Startup Community Way by Brad Feld and Ian Hathaway, who argue that ecosystems fail when they try to copy Silicon Valley instead of cultivating their own dynamics.

Entrepreneurial Traits: Curiosity, Perseverance, Self-Reliance

One of the most compelling segments comes from FI’s dataset on entrepreneurial psychology; now arguably the most robust applied social-science study of entrepreneurship in the world. Across 16 years of global cohorts, three traits consistently show a “ceiling effect,” meaning even the top end of the scale can’t capture how high successful founders score: curiosity, perseverance, and self-reliance. These aren’t buzzwords; they’re measurable indicators. Columbia Business School’s Rita McGrath has written extensively about adaptability and learning as the new competitive advantage, and FI’s data strongly reinforces that.

The regional differences Jonathan shows (Latin America scoring exceptionally high in motivation and risk tolerance, Australia high in autonomy but low in collaboration, Asia high in emotional control but risk-averse) emphasize his core argument: you can’t build an ecosystem by pretending your strengths are someone else’s. “Don’t try to be Silicon Valley” is not a slogan; it’s a policy imperative.

Mindset > Infrastructure > Money

Greechan’s critique of “Startup Capacity Building 1.0” is blunt: governments built campuses, created funds, and imported venture conferences instead of cultivating founders. Many inadvertently forced vertical integration (co-working spaces turning into accelerators turning into funds) which fractured collaboration and stalled growth. The fallout is familiar in regions around the world: siloed organizations, duplicated programs, and founders who don’t know where to go.

FI’s Playbook 2.0 reframes the work entirely.

First, widen the aperture: the addressable market for new entrepreneurs isn’t the 2,000 people already starting companies, it’s every resident with entrepreneurial traits who can be unlocked. Second, fix the mindset barriers (fear, perfectionism, risk aversion) that traditional education and corporate life hardwire. Third, deliver structured mentorship instead of loose networks. FI’s “no threes allowed” mentor rating rule (forcing feedback to be explicitly positive or negative) captures something long understood in cognitive psychology: humans are biased toward the neutral middle unless forced to choose, and that neutrality keeps founders stuck.

Funding as a Local Flywheel, Not an Import Industry

The final section tackles one of the most misunderstood parts of ecosystem design. Data from Pitchbook and NVCA consistently shows that early-stage funding is hyperlocal. Pre-seed and seed rounds overwhelmingly come from investors within a short geographic radius.

Greechan argues that waiting for coastal VCs to show up at this stage is magical thinking. Instead, cities must activate the capital already present: business owners, exited founders, family offices, and traditional investors holding portfolios full of commercial real estate and commodities.

Training emerging fund managers through VC Lab and educating LPs through LP Institute, both opportunities Founder Institute can activate for you, reflects a growing trend documented in Harvard’s recent research on alternative capital formation: successful ecosystems grow their own funds.

The Flywheel: Talent → Structure → Capital → Repeat

The session ends by zooming out. AI will accelerate job consolidation in large corporations; Marc Benioff’s widely cited claim that “AI is already doing 30–50% of our work” isn’t science fiction, it’s incentive alignment. Regions that fail to build entrepreneurial capacity now will struggle to maintain middle-class stability later.

The alternative is a flywheel: identify talent, develop mindset, provide structure, generate traction, attract local funders, create wins, recycle capital, repeat. Jonathan closes by arguing that this is no longer an economic-development strategy, it’s a societal resilience strategy. And in the post-AI era, it may become the primary one.

Founder Institute helps governments build capacity for economic development by providing the infrastructure necessary to activate their talent, empower the creation of new companies through structured mentorship, and ignite their funding ecosystem.

Coming up in December, see how regions worldwide are transforming through entrepreneurship, and learn how you can do the same. Join our live event “How to Create Sustainable Economic Growth through Capacity Building”.

Discover how organizations worldwide collaborate with us to launch impactful innovation programs.