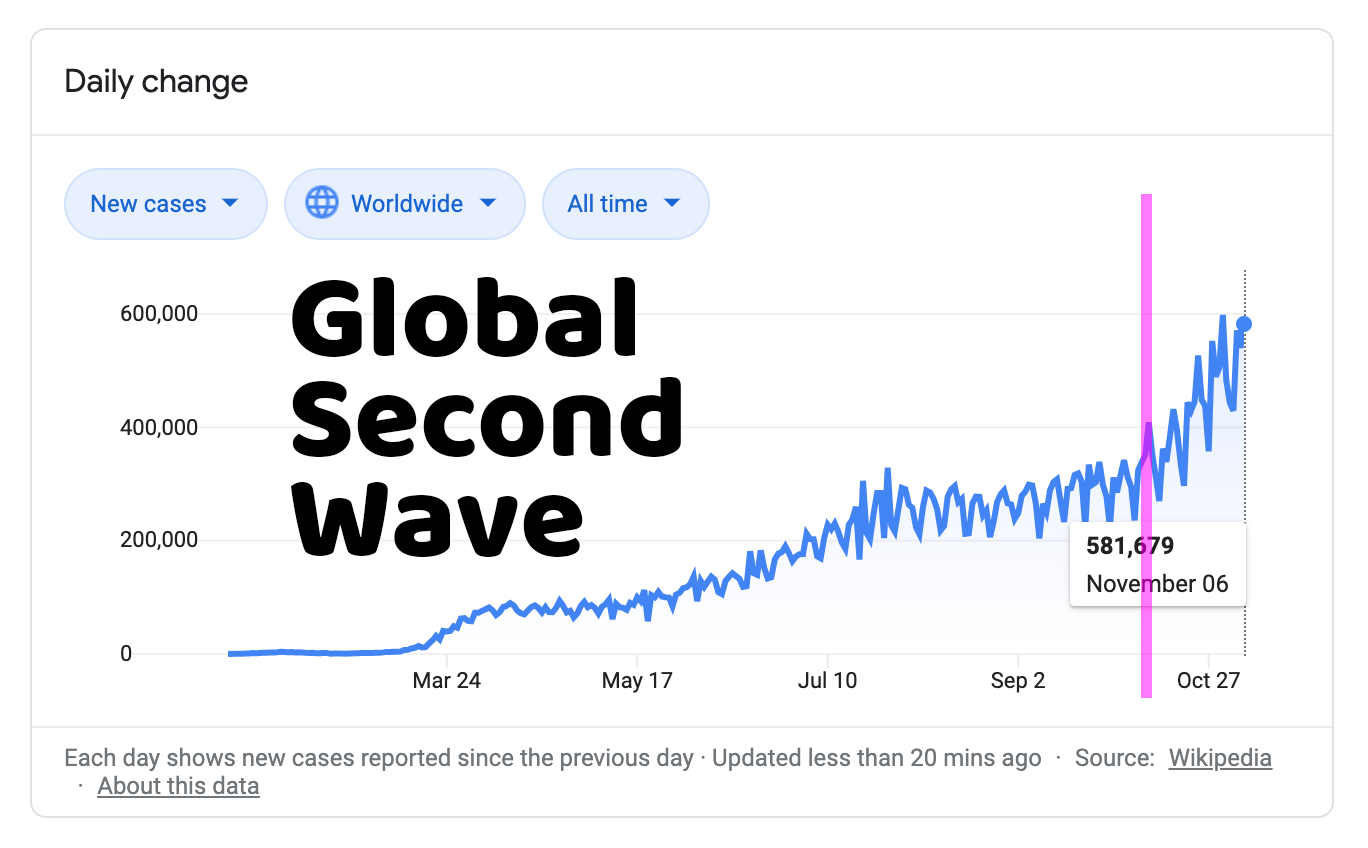

As citizens increasingly think of themselves and one another as consumers, the coronavirus's economic knock-on effects have impacted the retail industry heavily and visibly. Effects from changes in the retail sector are tangibly felt in the lives of everyday consumers - and now, the playing field has changed. For better or worse, only the strong in the retail industry are likely to survive.

Back in the B.C. era (Before Covid)...

Prior to the onset of the pandemic, even many well-established retailers across the globe were already in distress, from pressures like customer shifts towards online purchasing, as well as rent and other added costs of doing business in physical locations. The impact of COVID has caused many stores to announce that they will not be reopening after lockdowns lift, and more have brought in administrators to help reorganize the businesses. At the same time, startup retailers are finding it harder to access capital markets - and a number of these new businesses simply won’t have the cashflow to continue operating either, and will be forced to shut up shop early.

This of course means that those retailers who do survive the crisis can take advantage of reduced competition for the customer's coveted dollar. In fact, many categories of products, services and offerings will surely see a spike in demand throughout and eventually coming out of coronavirus - lifestyle products and services, educational products to support home-schooling, and products needed for remote working or simply in spending more time at home, are all seeing a healthy uptick in demand already.

Retail Industry Opportunities & Market Predictions:

Brick & Click Models

While the trend had been slow and steady for years, consumers have shifted rapidly towards toward adoption of online shopping during lockdown - and this isn’t likely to change upon reopening. Retailers who deliver true multi-channel experiences that offers consumers an educational framework or personalized product discovery will continue to differentiate themselves against competitors who do not offer such discovery and tailoring features. Customers are looking to make product decisions based on what matters to them, which falls on a wide spectrum - anything from clean ingredients to sustainability to activism. Scalable technology to personalize product recommendations is going to be crucial for driving retail sales as a whole.

Traditional physical retailers will need to ensure that they also offer a strong e-commerce service, and that they can justify their physical location by offering added value. Luxury fashion brand Louis Vuitton, for example, was notoriously slow in selling any of their products online, either through their own site or through third party sites, citing the fact that part of the luxury of their product was the luxury in-store experience.

However, the sales experiences are not mutually exclusive. Many customers still want to see and feel a product in-store, but then may return home to make the actual purchase online. And there is always going to be the recreational shopper, who feels real joy in going into stores - but these shoppers in the future will also favor the stores that provided added services or an amazing in-person experience.

Shop Small / Shop Local / Shop Independent Movement(s)

The retail industry is seeing a shift away from consumers spending in larger department stores and chains, and toward customers choosing smaller independent shops amid COVID-19. This is partly because customers are preferring to shop local to support small businesses in their neighborhoods during challenging times; but also because these stores are generally quieter, and social distancing is easier to maintain than inside a busy mall.

Malls are typically loud, crowded spaces, filled with recreational shoppers and loiterers alike, and their own futures in general are less than certain. Physical shopping may continue to be a necessity-only practice in many parts of the world for some months to come yet, and consumers are likey to continually prefer popping into their local strip mall or small shops to do their spending, versus choosing to enter into larger indoor shopping complexes.

Tech is Everything

Technology allowing more comfortable adaptations to the new realities of life post-COVID is hugely important. With an overwhelming number of customers still apprehensive to return to physical retail stores as lockdowns do lift, technology will need to become the bridge between the customers and physical stores, and arranging curbside pickups or delivery options (even from local retail stores) are likely to be an increasingly common consumer demands.

For many retailers, knowing your customer (KYC), understanding customer behavior changes, creating personalization and real-time interactions, will each increasingly be more critical than ever. The customer expects to be bombarded with advertising messaging from most retailer categories - so the retailers that effectively analyze their customer behavior or trends with the right metrics, and act upon those insights proactively, will increasingly step ahead of their competition.

Measuring the Right Metrics

To make up for financial losses during lockdown, retailers will be in greater competition to win precious consumer time spent in-store. To maximize value, customers will be engaged across online and offline channels, with offers inviting them into stores, or aiming to increase basket size or frequency.

Retailers with mobile apps will use location-based tech to engage customers, both in their own or third party stores stores that carry their products, to offer personalized campaigns and capturing customer attention during the limited time spent at physical store venues.

Understanding customers’ shopping experience and measuring the right metrics will become more important than ever. Pre-Covid trends may be irrelevant, as it is expected for so many consumer patterns and metrics to shift permanently, even after a future vaccine or effective treatment reduces the overall effects of the pandemic itself from the retail landscape.

For retailers with big physical footprints, here are just a few of the strategic shopping experience metrics that many are now carefully considering as new adaptations are made to pandemic realities, or locations are forced to close:

- Leaving Home Percentage: Compared to pre-Covid, how does the leaving home percentages differ?

- Mall vs. High-Street Preference: Do customers prefer to visit malls or high-streets when going shopping? How does this differ from pre-Covid?

- Mall Visit Count: How many times do the customers visit a certain mall? How fast is a certain mall recovering?

- Mall Visit Duration: How much time do the customers spend in each visit to a certain mall? How does this differ from before?

- Mall Visit Time Intervals: What are the most preferred time intervals for mall visits? How does this differ from pre-Covid?

- Total Time Spent: How much time do the customers spend for shopping? (Visit Count * Visit Duration) How does this metric differ from before?

- Store-Visit vs. Window-Shopping Duration Analysis: How is the Visit Duration breakdown between Window-Shopping Duration and In-Store Duration? How many customers loiter in the mall walking around the corridors and how many actually come to shop and spend more time in the stores?

- Store Category Visit Count: How many times do the customers visit a certain category of stores? Which categories recover faster than others? What is the split between essential & non-essential shopping?

- Store Category Visit Duration: How much time do the customers spend in each visit to a certain category of stores? Which categories are distinguishing from others?

- Store Visit Count Per Category: How many stores are visited in a particular category? How does this differ from before?

- Store Visit Count: How many times do the customers visit a certain store? How does the store foot traffic differ from pre-Covid metrics?

- Store Visit Duration: How much time is spent in a certain store? Did customers begin to spend more or less time in the store? Which stores do the customers spend more time in?

E-commerce Integration with In-Store

The ramped-up trend for customers to spend more and more online instead of in-store is unlikely to ever reverse backwards, or to return to the same levels as pre-COVID. There will always be a place for physical retail - but those retailers need to be able to ensure a seamless integration between their in-store and online experiences, supported by streamlined digital platforms and detailed analytics. Location-based technology will allow retargetting of customers with abandoned products from their online baskets while shopping in-store somewhere with offering similar items.

Augmented Reality

With the instructions from the UK government that, upon reopening of retail stores, customers will not be able to use fitting rooms, a huge opportunity has been created for the already-progressing use of Augmented Reality in retail. For example, the ability to virtually try on clothes and see what they look like on your own body, or visually see what a new sofa would look like in your living room - this is going to be a huge opportunity for the companies who provide these services for retailers.

COVID-19 has sped up the demand for this tech exponentially, especially on the mobile devices we now use for everything, as customers remain weary to go back to physicals stores except when necessary. There are a number of exciting startups forming in the area of AR/VR, as well as some traction from a few of the big e-commerce players.

Sustainability is an Incoming Tide

No doubt, one of the biggest trends impacting the retail sector both pre- and post-COVID is sustainability. Many studies put fashion among the list of worst-polluting industries, and with the increasing focus on climate change, consumers are choosing to consider the impact of their purchases on the planet, especially in physical purchase product categories. Coronavirus has made this trend even more prominent, as many are drawing connections between the slow onset of a global climate crisis and the ongoing effects of the COVID-19 pandemic.

Fast Fashion Era of Retail is Over

Fashion retail is probably heading the change for the sustainability agenda at the moment. The consumer movement away from ‘Fast Fashion’ has been gaining momentum for some years, and COVID-19 has brought this to a head. 5 -10 years ago, consumers were lapping up highly seasonal, cheap quality products, produced under often poor working conditions in developing countries. A customer could have a new outfit for every weekend party, without breaking the bank - and when they were done, usually after only a few wears, thrown away. Little thought was given to how a t-shirt could sell to an end customer for $5, and still have all parties of the supply chain make decent profits, with minimal negative environmental impact.

Fashion retailers like Zara and H&M could turn around on-trend products in a matter of weeks, and if they were not sold after a short stint in stores, they were heavily discount as they would be out of style shortly anyway. From there, it was a short trip via a customer for a few wears and onto the landfill. Companies like Burberry came under massive scrutiny for burning unsold products to prevent them from being sold off cheaply or stolen and thereby devaluing their brand. In the 5 years prior to 2018, £90M in clothes, accessories, and perfume were destroyed in this way.

As a result of the bad press and shifting attention, there has been a massive consumer pushback against this particular retail model. And coronavirus has been monumental in making this issue even more pressing: consumers under lockdown at home aren’t in need of fashionable throwaway clothes and accessories. Loungewear is largely timeless, and work from home may become a permanent arrangement for many; so some good quality loungewear may be a worthwhile purchase! People want things that last, and a large portion of the workforce continuing to work from home will drive demand for seasonless fashion, and items that can stand the test of time. Quality may be among the winners of the fall of fast fashion.

Retailers are now being held accountable for the sustainability of their entire supply chains, from raw materials to sales in-store. But there will be a trade-off with price. Sustainability comes at a cost that the end consumer needs to accept and pay, and coronavirus has nudged many in a sustainable direction. But the truth is that the consumer needs to be generally okay with buying less if they want to buy better.

Shift Away from Conspicuous Consumption

This trend impacts all retail buying, not just clothing. While under lockdown, consumers were really forced to think “Do I Really Need That?” Both from a financial perspective, with many households experiencing a dip in earnings, or from a point of individual reflection upon being cooped up in their own space. That new mentality is unlikely to go away for some time.

While some countries such as China, which has largely emerged from the lockdown, have experienced a retail surge out of pent up demand (sometimes referred to as “revenge shopping”), it has not made up for the sales downturn during lockdown. The same is likely to be duplicated elsewhere, where temporary "catchup" shopping is unlikely to replace the sales lost throughout the quarantine.

Throughout much of the west, shopping and ownership of luxury products are increasingly less viewed as the status symbols they once were. It is very possible that this is the tip of the iceburg, and it will be considered tasteless during the economic recovery period, to be flaunting wealth by buying expensive luxury products in a post-COVID world.

Circular Economy

COVID has also put a focus on consumers asking themselves: “What do I do with the item I no longer want / need?”

“A circular economy is an economic system aimed at eliminating waste and the continual use of resources. Circular systems employ reuse, sharing, repair, refurbishment, remanufacturing and recycling to create a close-loop system, minimising the use of resource inputs and the creation of waste, pollution and carbon emission.”

Prior to COVID, the talk of a circular economy was already gaining traction as part of the push toward increased recycling of domestic products, and other attempts to reduce waste sent to landfills. That momentum has gathered steam as customers continue to be more cautious of how much they are spending, and on what.

British fashion designer, Vivienne Westwood once said,

Buy less, choose well, make it last. Quality, not quantity.

If consumers buy better products upfront (and less of them), there are options to give them away to friends, to recycle, repurpose, or to sell, rent or donate them.

The events of the 2020 pandemic are upending almost every aspect of life in many respects. Retail is no exception, and is fact among the most visible sectors of the economy that everyone watches directly or indirectly. Old, traditional companies that want to survive the crisis will need to adapt or die, because the consumer's demand is changing, and it will drive the new post-Covid retail world.

Out of all market downturns come new opportunities - for savvy startups and their founders, there are new problems out there waiting and willing to pay for businesses to solve them. The rules of the game may have changed, but the strong will thrive.

Founder Institute Alumni guest contributor to this article included:

- Susan Daker, Founder & CEO of Bambinista (FI London), a sustainable kids’ e-commerce store and marketplace platform to bringing some of Europe’s best sustainable baby and kids’ brands to a larger audiences

- Sabrina Noorani, Founder & CEO of ClearForMe (FI New York), an API that enables Smart Product Discovery using a database of over 180,000 ingredients in our database and API allowing online retailers and brands to tailor product recommendations

- Batu Sat, Co-Founder & CEO; and Banu Mestanogullari, Chief Marketing Officer of Mall IQ (FI Silicon Valley), a San Francisco based company offering a scalable location intelligence platform for mobile apps that is store-level accurate indoors and outdoors without hardware deployments

Graduates of the Founder Institute are creating some of the world's fastest growing startups, having raised over 2BN in funding, and building products people love across over 200 cities worldwide. See the most recent news from our Grads at FI.co/news, or learn more about their stories at FI.co/journey.