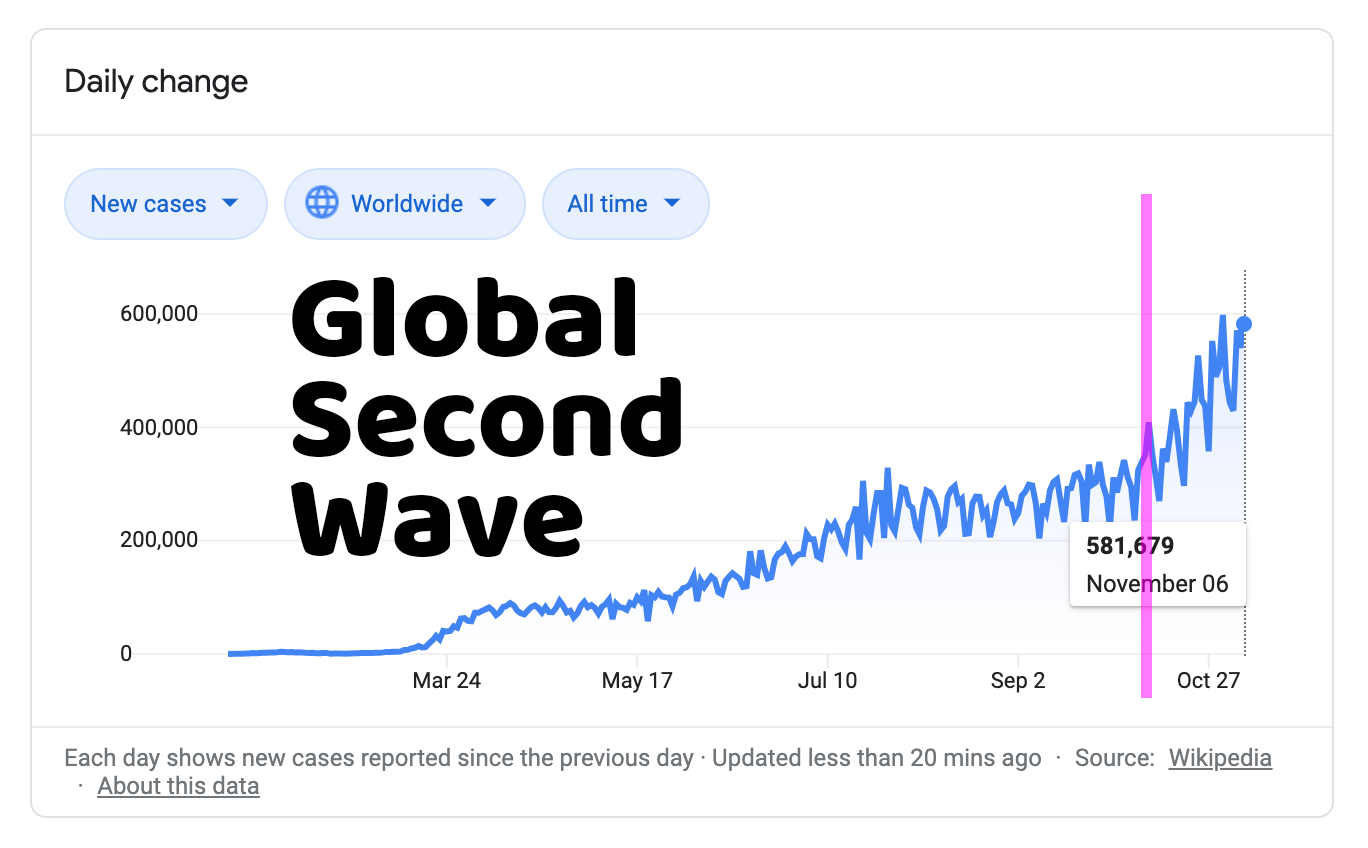

Closures and disruptions of business due to the ongoing COVID-19 pandemic have caused a global economic slowdown that is notably different from traditional recessionary or correction periods. As a result, governments around the world (at least in developed countries) have stepped in to intervene, and many have offered unprecedented emergency relief to businesses in an effort to stabilize employment, amid market uncertainties and disruptions to normal sales cycles.

Emergency business financing solutions are not coming from only governments though - now, even some private companies and organizations are offering limited emergency aid in the form of loans, grants, and other financing options. Known for its weak social safety net (relative to other developed countries), even the United States federal government has managed to mobilize itself in passing the enormous $2T CARES (Coronavirus Aid, Relief, and Economic Security) Act, followed by a $310B expansion of the PPP (Paycheck Protection Program) when the first $350B allotment was depleted in under 2 weeks.

Despite these heroic efforts, many businesses around the globe will fail amidst the backdrop of COVID - as some fall, new companies will rise to take their place. And the pure volume of new day-to-day problems in need of solutions for a post-COVID world, means practically unlimited opportunities for agile entrepreneurs. If you're pivoting your venture to meet a new market demand, or building a new company for the post-COVID-19 future, find out if the Founder Institute can help.

There are many resources available to small businesses and startups right now - the following are some great starting points, including emergency financing programs like grants and loans, as well as private offeringss and financing options available to SMEs in need of relief.

Finance, Emergency Loans, and Grants

- EU startups with tech or innovations that could help in treating, testing, monitoring or other aspects of Coronavirus can apply now for funding from the European Innovation Council.

- In the United States, here you can find the Small Business Administration (SBA)’s own Coronavirus Small Business Guidance & Loan Resources.

- On Pilot.com you can use a simple calculator to estimate your U.S. PPP (Paycheck Protection Program) loan amount as well as this guide to Calculating Your Cash Burn Rate through a downturn projection

- The National Venture Capital Association has published guidance on the PPP Loan Program and guidance for how companies can navigate the SBA lending process and affiliation rules.

- AlleyCorp has also created a PPP loan estimator as well as published an overview of government assistance programs.

- Techstars has a thorough guide that begins with the latest news in timestamped updates, outlining the United States C.A.R.E.S. Act (Coronavirus Aid, Relief, and Economic Security) in Overview and FAQs.

- Company Ventures and Emigrant Bank published this precisely technical resource on the United States CARES Act PPP and EIDL (Economic Injury Disaster Loan) programs.

- Fundera published this comprehensive but approachable guide on How to Apply for Coronavirus Business Loans, as well ascreated a wider Small Business Relief Hub with info on SBA's PPP, Disaster Relief, 7(a) Loan programs and other business credit options.

- Red Rocket Ventures’ blog published this short and approachable SBA loan Q&A.

- Get $100M in cash grants and ad credits from Facebook's Small Business Grants Program.

Special thanks especially to our friends at TechStars, the good folks at Grasshopper Bank, and to JetBlue Technology Ventures’ Ashley Lowes and Sarah Mattina, each of whose own resource lists and guides the Founder Institute team referenced in the creation of this COVID-19 financing resource guide.

Founder Institute portfolio companies are creating positive social and environmental impact around the world, using structured processes to define impact KPIs that scale sustainably with their business. Read the most recent featured reports on our impact companies at FI.co/good, or learn about the Founder Institute's own global impact at FI.co/impact.