Startup Funding Checklist

tl;dr Templates & Linked Guides

Don't have time to read the complete guide? You can access our Templates and Resources quickly below.- Early Stage Founder Cap Table Template

- Advanced Founder Cap Table Template

- Techstars Cap Table Template

- How to Build a Great Pitch Deck (Complete Guide)

1. Introduction

Providing funding for your startup is the foremost part of your business plan. Whether you rely on your own savings, the help of family and friends, angel investors, VC support, or simply on your bare revenue, the money has to arrive from somewhere before falling into its rightful place.

You might have heard that speaking to investors, pitching, and representing your startup is a full-time job. It’s true. However, just being there, setting up meetings, and participating in fundraising rounds doesn’t guarantee you success. To execute funding efficiently, you need to dedicate time to a checklist ‘formulation’. Once you create a sensible process and add all the ingredients, it is later only a matter of discipline and persistence to follow through.

Mike Suprovici, Founder Institute EIR and leader of FI’s Portfolio Success team, who has helped dozens of founders to successfully close their funding rounds, has this to say about the process of fundraising:

‘‘You will meet with well over one hundred people, and pitch your business hundreds of times. It will take over 20 hours per week for anywhere from three to nine months. You will become frustrated many times and will think about giving up.’’

Apparently, perseverance is vital to fundraising. TruStory Founder Preethi Kasireddy also doesn't mince words describing the amount of energy required for raising capital.’ She says,

‘‘There will be a lot of stress, anxiety, and sleepless nights. You’re going to go from one meeting to the next — back to back to back to back. Some will go exceptionally well, others will be lukewarm and frustrating, and the rest will make you want to doubt your idea, choice of career, and possibly existence on this planet.’’

Why now is an amazing time to nail your preparation for funding

Despite the slower funding environment in 2022, investors spent $100 billion more last year than the $342 billion invested in 2020. In 2021, startup valuations were largely overblown, and fundraising is now returning to a more balanced and healthier state.

In fact, the angel and the early-stage investments were least affected by the decline in 2022. At the same time, VCs still hold a record amount of dry powder (unused funds) waiting to be invested in resourceful startups that are capable of proving their merits.

In this post, we packed together the fundamental conditions that an investor will be looking for when evaluating your business. Ideally, you will score well on all these verticals and, as a result, will be able to raise capital. Your top prerogative right now should be to be ready! Go through the list and determine whether:

1. You are giving away enough time2. Have developed a business that has the potential to expand

3. Your organization is legally uncomplicated

4. You have done your finances homework

5. You have polished your pitch

6. You know where you’re going and can prove it.

Startup Funding Checklist: 6 Things You Must Do Before Asking for a Dime

1. Are you Working Full-Time on Your Startup?

Never forget what separates a startup from an ordinary business venture: A commitment to accelerated growth. The best way to achieve this objective is to focus 100 percent of your effort on scaling the company. Kind of hard to do with another full-time job, right?

Ask for financing while working a 9-to-5, and you won’t be taken seriously. Just imagine the tables are turned: Would you take a chance on someone who didn’t believe in their venture enough to quit their job? Probably not.

Just make sure you have adequate savings before quitting your day job. Gene Caballero, Co-Founder of GreenPal, worked 50+ hour weeks as a sales rep for Dell while building his startup. Though Caballero’s time was limited, he still managed to achieve steady growth. He explains,

When the numbers made financial sense (able to pay half of my bills), that is when I made the leap. Yes, it was still scary to leave a great job for something that was not guaranteed, but it's hard to change an industry working part-time.

As a rule of thumb, you should have, at the very least, 6 months of savings to live from while working full-time to finance your startup. Entrepreneur Ali Mese recommends having enough cash in the bank to cover expenses for a year, and then some:

Multiply that amount at least by three because you will be running out of your savings way faster than you ever imagined. Along the way, there will be so many hidden costs, accountant fees, lawyer needs, broken iPhones or PCs, etc. Get ready for a smaller apartment, smaller food portions, or counting your cents, which you never cared about in your life previously.

2. Is Your Business Venture-Scalable?

Before fundraising, it’s important to plant your feet firmly in reality. And that means putting yourself in the shoes of potential investors. Every early-stage founder must ask themselves: Is my business model scalable? Scalable businesses maintain or improve profit margins as sales volume increases. Translation: They don’t have to drastically increase spending to accommodate increased sales.

Remember, investors make money when their portfolio companies exit at significantly higher than the original valuations. For this reason, they almost exclusively invest in scalable business models with high profit margins. For example, a team of programmers only needs to build a basic product once before making it available to an exponentially increasing number of customers. Understandably, this makes technology-based business models extremely compelling to both angel investors and venture capitalists alike.

Conversely, a shoe repair company would not be appealing because of its inherent lack of scalability. The business owner would perpetually be hiring more staff, purchasing more tools and renting more space to support increased demand. All of these expenses would cut into the profits of investors. FI Mentor and GlowForge CEO Dan Shapiro explains it this way:

Most companies are not the right kind of companies [for angels and VCs]. And the only thing more frustrating and time consuming than raising a VC round is failing to raise a VC round. So think hard. Make sure it’s for you.

While there are plenty of worthwhile people-powered startups, these projects are not suitable venture funding candidates. With that said, even tech startups engage in “unscalable activities” when getting started. As Cate Costa, Founder of Venture Catalyst Consulting, outlines:

The founders of Airbnb initially went out door to door themselves to recruit hosts for their platforms. Clearly, that’s not a model that could be scaled well. However, they needed to get that initial critical mass to prove their concept, so that unscalable activity of the founders knocking on doors and talking to people was the only way to get to the scalable business that they built.

Obviously, differentiating between temporary and long-term unscalable activities is vital when determining your best options for raising capital. Should your business model fall into the unscalable category, you will either need to a) Pursue other routes of generating early-stage capital, or b) Choose another idea. Obviously, your decision will depend on your unique passions, priorities, and goals.

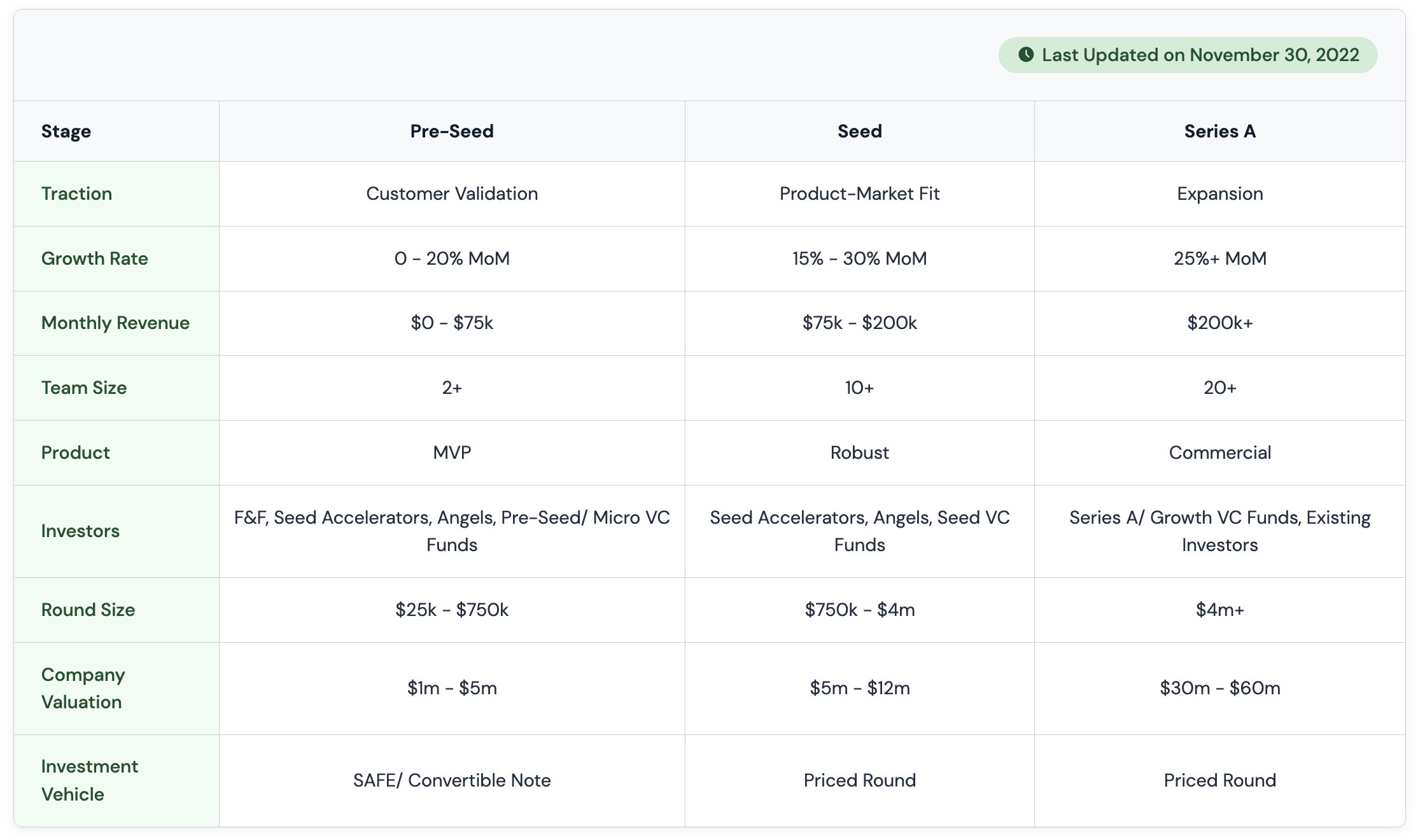

Finally, assuming that your business is venture-scalable, you need to be realistic about what stage you are currently in. Use the chart below as a rough guide, from FI.co/benchmarks:

3. Are you a Properly Incorporated Entity?

It may surprise first-time entrepreneurs to learn that angel investors and VCs in the United States prefer to invest in Delaware C-Corps and often require founders to re-incorporate their business in Delaware. The reason for the preference?

Many decades ago, the state of Delaware decided to boost their economy by writing favorable legislation for new corporations. This has resulted in a streamlined body of provisions, canon law, and court determinations that insulate management from risk. The legal precedents provide investors, board members, and startup attorneys with an unrivaled amount of predictability, as compared to corporations registered within other states. In simple terms, Delaware provides startups with the large amount of freedom they need in order to act fast when navigating minor legal issues.

Delaware’s filing office has a reputation for speed, efficiency, and dependability. The office is open until 8 p.m., and filings are routinely stamped within a day. Comparatively, the state of California dictates a large number of regulatory rules that can stall precious momentum.

Unfortunately, startup founders must also pay the additional expenses associated with qualifying companies at home. As for the C-Corp aspect, there are several technical advantages concerning income taxes and legal protections that are outside of the scope of this post. Click here to learn more about it.

Outside of the United States, there are preferred areas for incorporation all across the globe that are investor-friendly and founder-friendly. Just to name a few, in Southeast Asia the obvious choice is a "Singapore, Private Limited Company (Pte. Ltd.)"; in Europe, a "Germany, Unternehmergesellschaft (UG)" is a good choice; and in Latin America, a "Brazil - Limitada (Ltda.)" or "Sociedade Anônima (S.A.)" is preferred.

Also keep in mind that you don’t need to live in any of these countries to incorporate in them.

4. Do you have a Cap Table?

A capitalization table (or “cap table”) provides investors with a clear picture of company ownership.

With a quick glance, an investor can determine the percentage of equity owned by founders, investors, and employees (and in the case of a very early startup, the investor can also be assured that your team has had the difficult conversations and properly structured the business). These numbers answer an important question: Who, ultimately, has control over this startup? Considering that most startups require voting agreement among both common and preferred shares, the cap table provides valuable insight as to how important decisions will be made.

As companies continue to grow, and equity continues to dilute, cap tables also become increasingly important to founders. Maintaining a firm grasp on shareholder impact is vital when evaluating employee options, term sheet negotiations, etc.

The good news? Creating your first cap table doesn’t have to be complicated. A simple Excel spreadsheet with minimal data points will suffice.

As you can see, shareholder names are placed in the left column and capital contributions in the right column. Traditionally, co-founders and investor groups are listed from earliest to most recent. You should include the number of shares purchased from each class and the resulting ownership percentages on a fully-diluted basis (which means you include the options, whether issued or non-issued, vested or non-vested).

Click here for an early-stage founder cap table template.

It’s worth mentioning that cap tables become increasingly complex the more investors come onboard. For this reason, funded founders rely on additional best practices, formulas, and terms when creating cap tables.

Venture Hacks does a great job of walking through these complexities in the video below:

Click here for an advanced founder cap table template.

Also, if you’re the type who hates manually updating spreadsheets, consider a service like eShares. It’s a cap table management software that digitizes paper stock certificates along with stock options, warrants, and derivatives.

5. Do you have a Strong Pitch Presentation?

Though it may seem obvious, it’s worth mentioning: Pitching investors without a plan is a waste of everyone’s time. Your ultimate success depends on your ability to effectively convey who you are, what you’re doing, and why it matters in 30 minutes or less.

In order to stand out from the dozens of other pitches potential investors hear every week, your presentation must include a little something extra. Ideally, that “je ne sais quoi” is a memorable story that clearly illustrates a compelling business opportunity.

As Jasmine Foroutan, CEO and Founder of Pitch Genius, says, investors want more than rote slideshows:

The biggest challenge of making a memorable deck is building a storyline that echoes outside of the pitch deck. This means, building a storyline that is not only easy for investors to remember, but also a storyline that’s easy for them to repeat and regurgitate to other potential investors.

Memorable pitch presentations clearly answer questions like:

- What problem does your startup solve?

- Is that problem within a big enough market to get investors excited?

- Does your solution have a competitive or sustainable advantage?

Of course, your pitch deck should also provide detailed information about your business model, qualifications for execution, and proven traction (more on that in a moment). Ultimately, the key to nailing your startup pitch isn’t rocket science: you simply need to practice delivering it over and over again. Listen to feedback from peers and mentors, and refine your messaging until you get it right. For this reason, Founder Institute participants are required to pitch with and receive feedback from their cohort peers.

See our comprehensive guide: How to Pitch Your Startup.

6. Can you Demonstrate "Traction"?

Watch a few episodes of the hit TV show Shark Tank, and you will witness lack of traction in action. If you’re not familiar, the show provides budding entrepreneurs with the opportunity to pitch a panel of famous investors. Over the course of any given season, “the sharks” repeatedly tell founders that their valuations are too high. Why?

The entrepreneurs don’t have enough traction to justify their proposed terms of investment.

In simple terms, traction is proof that somebody wants your product. However, what qualifies as traction isn’t absolute—ask five different investors for definitions, and you may receive five different answers.

At the Founder Institute, we divide traction into the overarching categories of Growth Metrics and Validation. Below are the differences between the two modes of evaluation, and subcategories that can be found within each:

Growth Metrics (Quantitative)

Investors value growth metrics for their tangibility. As the saying goes, “The numbers don’t lie!” Unsurprisingly, the most important growth metric is revenue.

While not an absolute prerequisite for fundraising, demonstrating that real people are consistently paying for your products and services is the easiest way to garner interest from investors. The good news? Angels aren’t expecting a pre-funding startups to already be generating millions of dollars in Annual Recurring Revenue (ARR).

However, savvy investors do want to see evidence of financial progress. For example, say your startup generated $2,000 this month. Not that impressive, right? However, let’s also assume you have consistently doubled revenue Month over Month (MoM) since inception. Suddenly, that $2,000 appears to be significantly more noteworthy.

Understandably, complex business models will be hard-pressed to achieve financial traction early on. In such instances, founders can demonstrate alternative proof of growth metrics, like:

- Downloads

- User Numbers

- Visitor Numbers

- Waiting List Sign-ups

- Mailing List Subscribers

- Retention

- NPS Score

- Viral Coefficient

Again, the numbers don’t have to be huge. Just remember that angel investors most value consistent MoM growth in one form or another when evaluating traction. FI Mentor and GlowForge CEO Dan Shaprio explains it this way:

VCs want to invest in companies that can grow explosively. That means huge markets, executives who can scale up a business fast, and a willingness on the part of management to double down on a winning bet – over, and over, and over again.

Obviously, what constitutes traction also varies with the type of business you are building. Use the below table as a rough guide by industry, from FI.co/benchmarks:

Validation (Qualitative)

The second form of traction investors care about is validation from interested third-parties. Basically, you want to emphasize anyone of importance who believes in your startup’s mission, product, or services. Here are the most commonly referenced types of validation:

- Outstanding Team Members: Most early-stage investors will tell you they invest in teams, not ideas. While we’ve never seen someone overlook a truly horrible idea because of an impressive team, the stereotype isn’t far from the truth. The reality is that there is no shortage of great ideas on this planet. Most investors would prefer investing in a well executed but “mediocre idea” over a poorly executed “billion-dollar idea” any day of the week! For this reason, one-person startups have the added burden of answering the unspoken question: If this person can’t convince someone else to work full-time, can they convince anyone else their product or service is of value?

- Social Proof: For better or worse, investors give weight to the opinions of those with industry clout. Has an impressive person informally given your startup their seal of approval? Politely reference the endorsement in your pitch presentation.

- Advisors: If you’re beginning your entrepreneurial journey with zero connections, we recommend procuring advisors with expertise in your business vertical. The verbal recommendation of a respected name may be the difference between a yes and a no from an “on the fence” investor. The Founder Institute has created a simple legal agreement to create advisor relationships, and joining a pre-seed accelerator like the Founder Institute can also help.

- Media Coverage: Right or wrong, the words published by media outlets carry more weight than run-of-the-mill blogs. Especially those published by widely recognized news sources. The good news? It’s never been easier to pitch reporters story ideas via resources like HARO, Twitter, and LinkedIn. Pro Tip: Begin building relationships with reporters within your industry before you ever need publicity.

- Community Approval: Finally, don’t underestimate the power of regulatory acceptance. You can prove qualitative traction by emphasizing participation in respected accelerator programs, pitch competitions, and industry events.

Additionally, keep in mind that your industry will dictate traction metrics that are unique to you. For example, a fashion subscription startup may want to highlight photo uploads, social media interactions, and pure user numbers.

The bottom-line: Use all the evidence you have to creatively, and honestly, demonstrate forward momentum. Note that graphics, charts, and visuals can be your best friend when trying to illustrate traction.

Conclusion

Setting up an initial meeting is relatively easy. Investor email addresses can often be found on company websites, and contacts can be established via social media. The challenging part will be checking off the aforementioned boxes that make investors care. Remaining sharp and organized reduces the chances of failure. Adequately assessing the benchmarks investors pay attention to will build the necessary strength in you. Moreover, consistency and thoughtful management will enhance the quality and flow of your pitch.

Last but not least, have your magical reminders in place at every step because they will win you a positive reputation. Especially because angel investors and early-stage VCs are a tight-knit group of people, and, unless you’re raising at an international level, players in the same field will likely know each other. This means they exchange their opinions and impressions, so information travels quickly across your local venture network.

Still have questions about fundraising?

Find a detailed overview of our methodology here: https://fi.co/overview

If you want to know more about how Founder Institute supports graduates even after the end of the program, visit: https://fi.co/scale.

The Founder Institute hosts startup events in 200 cities around the world, including many fundraising 101 events. Helping budding entrepreneurs turn visions into reality is our passion. Click here to find the next event near you, and come say hello!

Ready to start building traction?

The Founder Institute’s 4-month accelerator programs are designed to take pre-seed founders from the early stages to achieving traction and getting prepared for funding. We provide founders with weekly business mentoring, pitch deck feedback, and warm introductions. Our core programs are run by local leaders in their startup ecosystems, experts with proven track records of success. This approach has led to more than 8,900 portfolio companies that have raised 2BN+ in funding.