If you are an entrepreneur, you are probably familiar with the 10-14 slides that comprise a typical investor pitch deck. But do you even know why you need a pitch deck in the first place? Or what you should include in your deck to increase your chances of getting funded?

Malcolm Lewis - a serial entrepreneur (6 startups in 18 years, 3 public company acquisitions, 1 $BB IPO, and 2 TBDs) and a startup mentor/adviser - has provided a comprehensive guide on what your pitch deck should include, along with plenty of examples. Malcolm has also served as a Mentor for the Orange County Founder Institute.

The post, "The Pitch Deck: Why You Need a Pitch Deck and What to Include in Yours, or Everything You Ever Wanted to Know About Pitch Decks But Were Afraid to Ask", originally appeared on Pitch Deck Coaching. An excerpt has been republished below with permission.

What Do Investors Want to See in Your Pitch Deck?

To answer this question you need to understand what investors are trying to accomplish when they read or listen to your pitch deck. But before we get into that, let's pause for a second to consider what you're up against.

Here's some recent data from Andreessen Horowitz (a16z), one of the hottest VC firms in Silicon Valley right now. Each year, 3,000 startups approach a16z with a "warm intro" from someone the firm knows (read Pitching Hacks for more advice on warm intros). A16z invests in 15 of those 3,000 startups. Which means they say "yes" to one in every 200 pitches, and "no" to the other 199. So the odds are against investors saying yes to your pitch. But don't despair. Approximately 4,400 startups did get funding in 2014 so it can be done.

So what do you think investors are looking for in those one-in-200 odds-defying pitches? Here’s a clue: they are investors. So, like any investor, they are evaluating your pitch in two areas:

- Return: The potential return (aka upside) on an investment in your business

- Risk: The risks that might prevent them from getting that return on their investment

An investor's job is to find businesses that offer the highest return on investment with the least risk. Your job is to convince them that your business offers a greater return, with less risk, than all the other businesses they are looking at.

Regarding return, remember that most investors are looking for at least a 10-20x return on their investment in a business. (And in their dreams, they are hoping you will be the next Google or Facebook or Uber and drive a 1,000x return.) So you need to convince them that you can grow your valuation at least 10-20x from its current baseline.

Setting tech bubble valuations aside, business valuations are typically driven by revenue and profit multiples, so you need to show how your product will dominate a huge market and generate the revenue and profit growth required to drive a 10-20x increase in the value of your business.

Regarding risk, understand that when investors read or listen to your pitch deck they are trying to assess your investment risk in three key areas:

- Market Risk: Are you addressing a large, growing market?

- Product Risk: Can you build a compelling product with sustainable competitive advantages?

- Execution Risk (aka Team Risk): Can your team acquire and retain new customers profitably, at scale, and transform your opportunity into a substantial long-term business?

Market failure is usually driven by a product in search of a market that doesn’t exist (“the dogs don’t like your dog food”) or is too small to be interesting to investors (i.e. there’s not enough potential revenue to generate the 10-20x return they want). Startups led by engineers can often fall into this trap.

Product failure is typically driven by a product that is not useful, not usable, or simply not competitive.

Execution failure is generally driven by some combination of inexperienced leadership, ineffective sales and marketing, and poor financial management.

Note that some initial traction (e.g. several months of accelerating customer adoption and revenue growth) can go a long way toward minimizing market, product and execution risk for many investors. It will certainly greatly increase your chances of getting funded. More on traction later.

Want to use your pitch deck to get into an accelerator? "Read this Before Applying to an Accelerator"

What Should You Include in Your Pitch Deck?

Now let’s take a look at what you should include in your deck and why. First, remember that your pitch deck is a visual summary of your business. So it needs to address every aspect of your business that you might include in a business plan.

There are many opinions on exactly what 10-14 slides should be included in a pitch deck, and in what sequence. For the sake of argument we’ll use the slide titles and sequence (flow) I use in a sample pitch deck I have created for my pitch deck coaching business. I'll use screenshots from the current version of this deck to illustrate some of the information you should consider including on each slide of your deck.

Before we get into details, here's the outline:

- Cover: Announce your big idea. The one thing you do better than anyone else. You have 10 seconds to engage your audience.

- Summary: Summarize the highlights of your business/investment opportunity as a teaser.

- Problem: The problem you solve, who you solve it for, and the reasons why your target customer/users are frustrated with current solutions.

- Solution: How you solve the problem and the benefits of your solution.

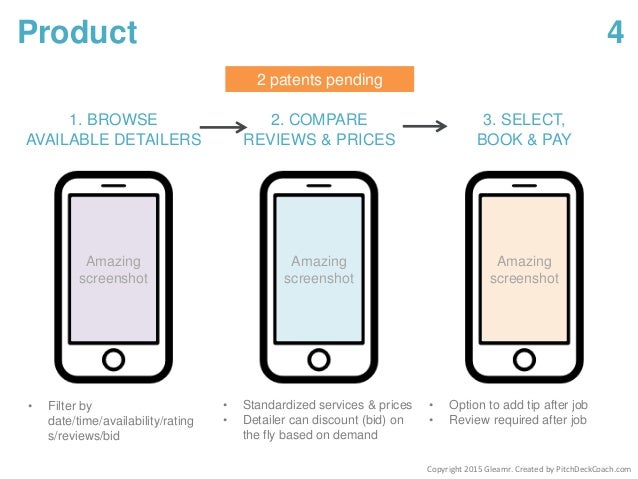

- Product: Your product and how it works in three simple steps.

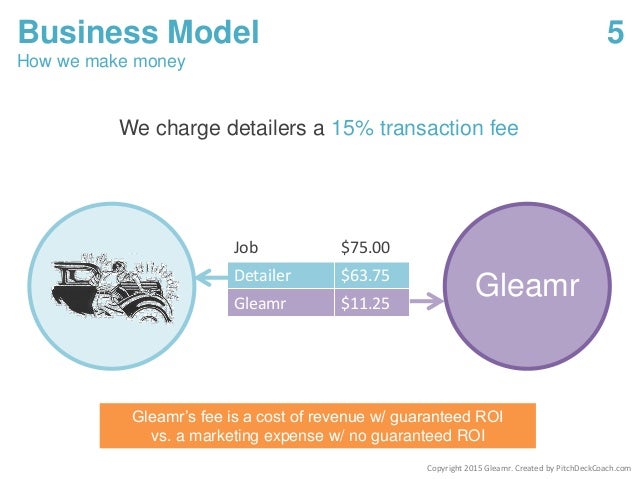

- Business Model: How you make money.

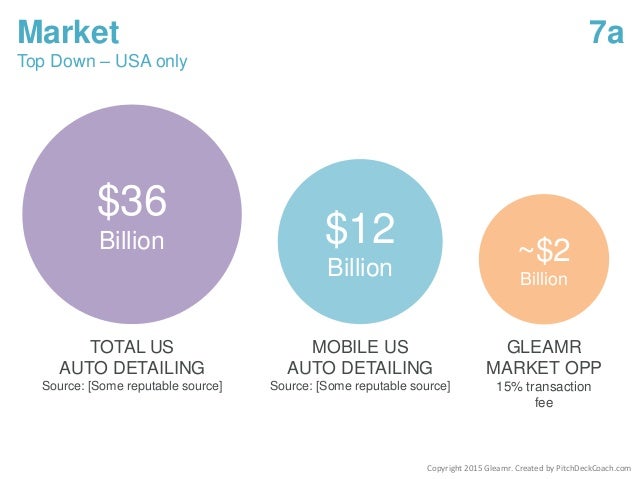

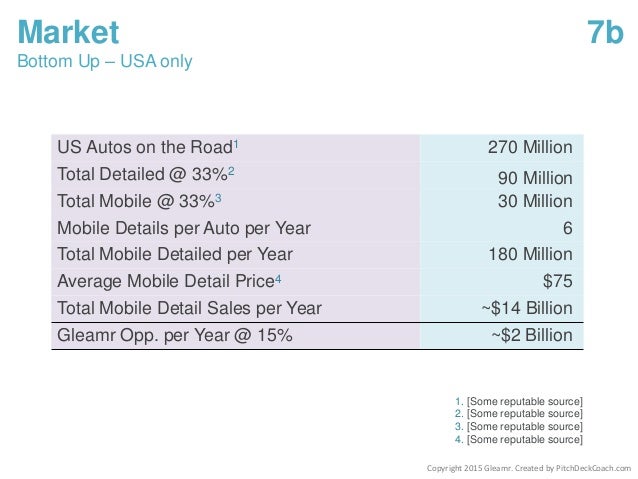

- Market Opportunity: How much money you could make if you dominate your target market.

- Competition: Your competitors and why your product is better than theirs.

- Growth: How you will acquire and retain customers, profitably, at scale, and keep your product competitive.

- Traction: Tangible proof that your customers love your product and are happy to pay for it.

- Financials: Your current best guess of how much money you will make in the next 3-5 years.

- Team: The team that has the experience and expertise to transform your opportunity into a large, profitable business.

- Funding: How much money you need and what you will do with it.

- Summary: Summarize the highlights of your business/investment opportunity as a closer.

- Appendix: Not mandatory, but feel free to include a few slides with positive press mentions, happy customer quotes, a summary of your technology stack, your detailed financial model, etc.

Okay, so that's the pitch deck outline. Now let's take a look at each individual slide and highlight some of the important things you should include. (Note that you can find these slides on Slideshare if you want to see the entire deck without my notes.)

How Much Content Do You Need on Each Slide?

Note that you'll need two version of your pitch deck. The "read me" version and the "listen to me" version. Many investors will want to see your deck before they agree to meet you. This means your "read me" version needs more detail so it can stand alone. Your "listen to me" version is the one you use when you can present in person. You need fewer details on your slides because you replace them with speaking points. This ensures that investors spend more time listening to you and less time reading your slides. Think Steve Jobs, the Zen master of the "listen to me" pitch.

You can find some great examples of founders giving their "listen to me" pitches on the various incubator websites such as Techstars. Just remember that these decks are their "listen to me" versions. In case it's not obvious, you should start with your "read me" version and then edit out the detail as required to create your "listen to me" version.

Looking for advice on a shorter 'elevator' pitch? Consult "The One Minute Startup Pitch Template"

Cover Slide

Use this slide to introduce your big idea. Your goal is to grab the investor's attention in the first 10 seconds so you have their attention for the next 20 minutes. Describe what you do in a simple declarative statement. Eg: “Mint is a quick and easy way to track your spending online.” Or use a well-known company as a comparison. Eg: DogVacay is “AirBnB for dogs.”

Include a statement of the primary benefit for your primary customer/user if you like. And add a simple image if it reinforces your big idea without distraction.

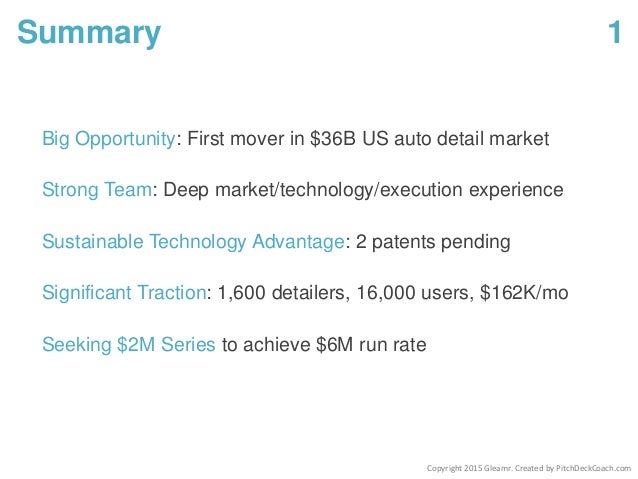

Summary Slide

Summarize the highlights of your business opportunity before you go any further. There's no reason to make investors wait until the end of your presentation. In fact, without this summary they might not bother reading or listening through to the end at all. Why not give them something to look forward to instead? Remember, they are looking for investments that provide maximum return with minimum risk. So make sure you emphasize the upside potential of your business opportunity and explain how you have minimized market, product and execution risk.

Nothing says "fundable" like traction. It provides instant validation of your business and gives you instant credibility. With traction, investors will assume everything you say is probably true. Without traction, investors will assume everything you say is probably not true. Or at least unproven. So if you have any traction make sure you highlight it right here.

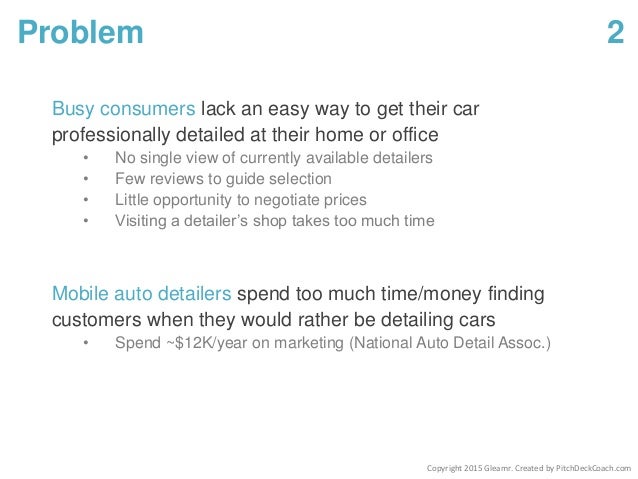

Problem Slide

Explain the problem you solve (or the unmet need you address) in simple terms that any investor can understand. Identify the people who are dealing with this problem. These are your target customers and users. (Users use. Customers pay. For example, people searching for golf clubs on Google are Google users. Companies that advertise on Google are Google customers.)

How painful is the problem? Is it a must-solve problem or a nice-to-solve problem? Is it the number one problem for your target customers and users, or a minor irritation? How do your target customers and users solve this problem today? Manually? Or with some older generation technology? And what are the issues with these current solutions (your competitors) that create the opportunity for a new solution like yours? Is your problem obvious? If not, what proof do you have that it exists?

Note that your Problem slide is the setup for your Solution slide and, later, your Competition slide.

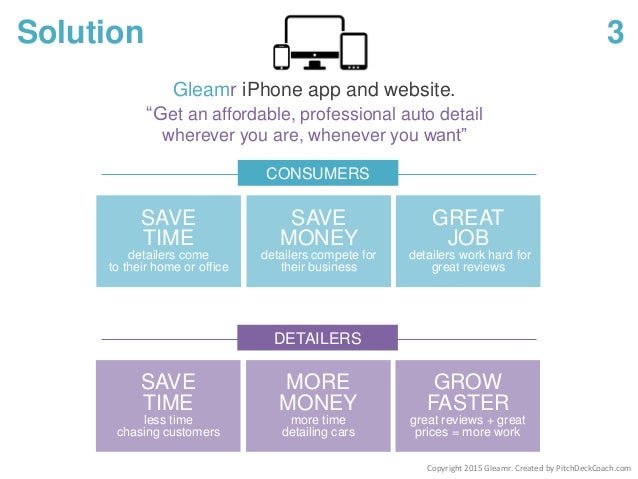

Solution Slide

In your Problem slide you should have explained, or at least hinted at, how your target customers and users have been solving their problem before you came along. And you should have discussed or listed the issues (your target customers' frustrations) with those current solutions.

Now it's time to describe your solution. Again, use simple language. What is it? An app? A website? A device? What does it do? And what are the major benefits of your solution for each of your target customers and users? Ideally, those benefits are derived from features that address the issues with current solutions that you identified earlier. So if current solutions are slow, expensive and difficult to use then what is your solution? Hopefully easier to use, faster and less expensive. That of course begs the next question, which is by how much? How much easier to use? How much faster? How much cheaper? Enough for your target customers and users to care?

Product Slide

In your Solution slide you described the "what" and "why" of your product. What it is, what it does and why your target customers and users will care enough to stop using current solutions and switch to your solution. Now you need to make your product more tangible to investors. One simple way to do that is to explain the "how."

Because it's simple, I like to show how a product works in three easy steps. Remember to show your product user experience for each customer and user identified in your Problem slide. Note that you don't need to do a demo here. Screenshots (or video) are fine and have the additional benefit of never crashing in front of investors. And they work great for investors who are skimming through your deck while standing alone in line at Starbucks.

Your Product slide is also a great place to highlight any technology patents you might have been granted or have in the works. If your patents are really important, and will prevent competitors from copying critical aspects of your solution (think Overture's patent on pay-per-click advertising), then you might even want to add a dedicated Technology slide. Regardless, describe your patents briefly, explain where they fit into your solution (are they core or peripheral?) and mention their filing status.

Business Model Slide

Now it's time to explain how you make money. Keep it simple. Focus on the primary revenue model you will actually use to monetize your customers rather than a laundry list of potential revenue streams. Investors generally prefer active revenue streams (customers paying for the use of a product or service) to passive revenue streams (eg: advertising or affiliate revenues) unless the passive revenue stream is attached to a very sticky free product like Google or Facebook. Investors generally like recurring revenue streams like monthly or annual subscriptions.

If possible, provide some proof that your target customers are willing to pay your price. A growing base of paying customers would be ideal proof. But a quote from a prospect is better than nothing if you have not yet launched.

Your Business Model slide should segue nicely into your Market Opportunity slide where you'll show how much money you could make if you dominate your target market. Your pricing model will drive the bottom up version of your Market Opportunity slide.

Market Opportunity Slide

Your market is the collection of people who will pay you to use your product or service. Many investors like to see both a top-down and a bottom-up analysis. I think the bottom up analysis is generally more credible. If you only pick one version, I suggest you choose bottom up.

A typical top-down analysis shows the following three market sizes. Be sure to reference the most credible sources available for your top down market sizing numbers. I suggest you don't use global numbers unless you expect to be a global business within your first few years. Include growth rate (CAGR) data if you can. Investors would rather invest in a market that is growing versus a market that is stagnant or shrinking.

- Total Addressable Market (TAM): All the people who could use your product or service. eg: All auto detail customers in the US.

- Serviceable Addressable Market (SAM): The subset of your TAM who are likely to use a product like your current product. eg: All mobile auto detail customers in the US.

- Serviceable Obtainable Market (SOM): The subset of your SAM that you can reasonably obtain in the next 3-5 years. Aka your realistic market share. eg: 10-20% of all mobile auto detail customers in the US.

Be sure to reference any external forces, such as new technologies or new legislation, that could accelerate the growth of your market or extend its life. This helps investors answer the "why now" question.

A bottom up analysis uses simple math to size your market opportunity. How many people could buy your product each year? And how much would they pay? This analysis lays out your two basic assumptions for investors: 1) The number of customers (or customer transactions); and 2) The average price paid per customer (or transaction) per year for your product. Hopefully investors will agree that your assumptions are reasonable. I prefer to round big numbers to make them easier to process and remember.

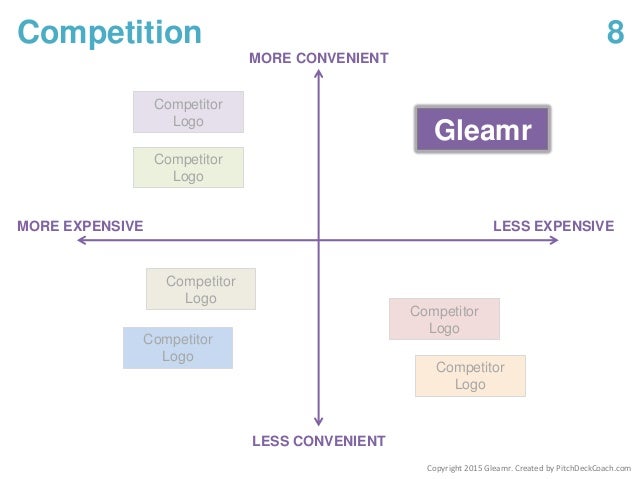

Competition Slide

This is where many pitch decks fall short. Your Competition slide is critical for most investors and yet many startups do a very poor job of differentiating their product/solution. Remember that investors are looking to minimize both market risk and product risk. It's easy to identify a large, growing market, but much harder to build a product that is so much better than current solutions that the majority of your target customers and users will switch from those current solutions to your product.

Don't make the mistake of saying you have no competitors. You will lose credibility fast. A market with no competitors suggests to investors that your market doesn't exist or is too small to be worth pursuing. You must identify your competitors and you must provide at least 1-2 reasons why your product is better than them.

Bear in mind that you will typically have both direct and indirect competitors. Be sure to identify both. Google, for example, competes directly with Microsoft (Bing), Yahoo, Facebook and other providers of online advertising. They also compete indirectly with TV, radio, print and other providers of offline advertising.

Of course, if you are pioneering a new technology, your competition might only be the old manual way of doing things. For example, before Uber we all had to call a cab company for our 5am ride to the airport and then pray that they would actually show up.

You have a couple of options regarding the layout of your Competition slide. The first is the classic "Gartner Magic Quadrant" inspired 2x2 competitive landscape chart used in the Gleamr example below. Here you will identify the two most important points of differentiation between you and your competitors and construct your chart accordingly. In the example below we are saying that Gleamr's on-demand app for mobile auto detailers is more convenient and less expensive than other options available to busy consumers looking for a mobile auto detail in a hurry.

A second option is the competitive matrix/grid. This is the classic "we have it, they don't" grid. With this option you will list important solution feature/benefits down the left side of you grid and then list yourself and your competitors across the top of the grid. Note that "important" is defined by what your target customers consider important, not you. So with 5 feature/benefits and yourself plus 3 major competitors you would end up with a 5x4 grid. Hopefully your solution will be the only one that checks the box for all 5 feature/benefits that drive your target customers' purchase decisions.

Growth Slide

This slide addresses execution risk. Investors want to be convinced that you know how to transform a competitive product for a large, growing market into a substantial, sustainable business. Any successful business executes well on these three operational activities:

- Customer Acquisition: How do your Sales and Marketing teams create awareness and generate demand for your product to acquire new customers?

- Customer Retention: How does your Customer Service team keep your existing customers happy so you don't lose them to your competitors?

- Product Innovation: How does your Product Development team keep enhancing and extending your solution so that it remains competitive?

There are three very important numbers (key metrics) you need to explain to investors to demonstrate that you have a viable business that can scale. You need to acquire empirical data for these three numbers as quickly as possible. They are:

- Customer Acquisition Costs (CAC): What's your total fully loaded cost to acquire a paying customer? Eg: $100.

- Lifetime Value of Customer (LTV): How much will a customer pay you before you lose them? Eg: $100/mo x 48 months = $4,800

- Payback Period: How long does it take for a customer to cover their acquisition cost? Eg: $100/$100/mo = 1 month using the example above.

Being able to generate an LTV that is a strong multiple of your CAC is a basic prerequisite for a profitable business. Of course, you'll also need to cover your cost of revenue and other operating expenses, such as product development and customer service, to be profitable.

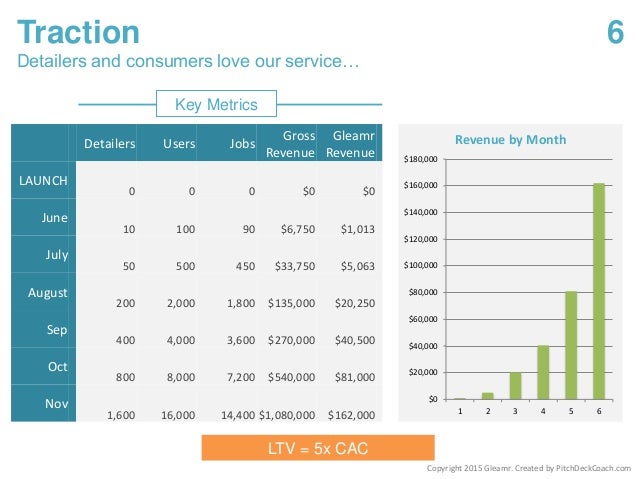

Traction Slide

This is one of the most important slides in your deck. It addresses all three aspects of risk that investors are looking to minimize as they evaluate you as an investment opportunity, namely market risk, product risk and execution risk. By definition, if you are acquiring customers, there must be a market for your product, you must have a competitive product, and you have demonstrated enough operational expertise to successfully market and sell your product to at least some of customers in your market. The only questions that remain at that point are can you replicate your initial success at scale and can you keep your product competitive as you grow.

Assuming you can acquire customers profitably, or at least show a trend of declining acquisition costs to demonstrate a path to profitability, you switch from asking investors to fund a proof of concept (with lots of market and product risk) to asking them to fund growth (which is mostly execution risk).

Traction is measured by acquisition, engagement, retention and revenue numbers you should identify to investors as your key metrics. These are the numbers you use to manage your business and measure success. Traction metrics might include customer acquisition costs (CAC), lifetime value of customer (LTV), total number of paying customers, monthly active users (MAUs), monthly recurring revenue (MRR), average revenue per user (ARPU), monthly churn rate and so on.

When using key metrics to illustrate traction, be sure to highlight trends and rates of change. An ideal scenario for investors, for example, might be customer and revenue doubling monthly coupled with declining customer acquisition costs.

If you haven't yet launched your product, then consider using this slide to instead identify major milestones for product, key hires, funding, etc. Even if you don't have traction, I would always identify your key metrics. It tells investors you understand the mechanics of your business and the levers you will need to pull in order to make it successful. When discussing key metrics I like to include revenue drivers. More on this on the Financials slide coming next.

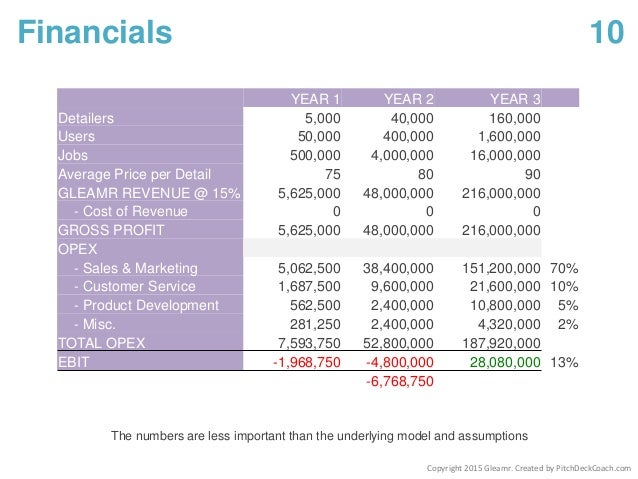

Financials Slide

Your Financials slide is your current best guess projection of revenue, costs and expenses over the next 3 years. The numbers themselves aren't that important as long as they are not so small that they are not interesting to investors and so large that they are completely unbelievable. My advice is to get them into the right ballpark and highlight your key assumptions in the model, such as your revenue drivers and the amount of money you will spend on key operations such as marketing, sales, product development and customer service. Investors can then decide for themselves if they think your assumptions are reasonable.

I like to include cumulative EBIT (Earnings Before Interest and Tax) so that investors can see how much money you will burn before you stop losing money and become profitable. I also suggest you include percentages alongside your numbers to save investors having to do math in their head for things like gross margin and sales and marketing as a percent of revenue. Most investors have a good idea, based on experience, of how revenue should be reinvested into each operation in order to grow a startup business to critical mass.

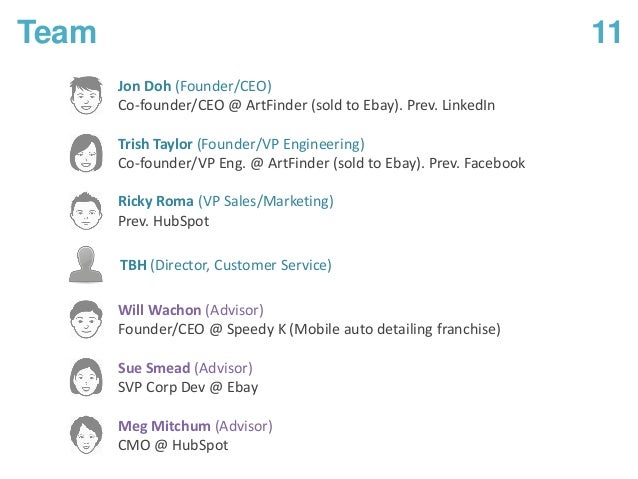

Team Slide

Your Team slide is another critical slide that often gets insufficient attention in the pitch decks I have seen. It speaks to execution risk. Investors want to know that the team has significant experience and expertise in as many of the following areas as possible:

- Similar Startups: Eg: Founders or early/key employees in a similar startup. Bonus points for a startup that became a market leader and/or achieved a successful exit.

- Similar Technology: Eg: Built a similar product for another company or startup.

- Similar Markets: Eg: Successfully marketed and sold products into the company's current target market.

At a minimum, your team should include a business guy (who owns/drives the company and product visions) and a technology guy (who owns/drives product delivery). I am of course using "guy" in the generic, gender neutral sense. Investors also like to see brand name startups on a team member's resume. And they also like to see team members who have worked together before, ideally for another startup, especially if that startup was successful.

Note that your Team slide should include every important member of your extended team. This should include founders, key employees, advisors and investors (if any). Creating an advisory board is a very simple way to add industry expertise to your "team" and is something that I strongly recommend For example, being able to drop a line like "We have the CMO of the largest real estate brokerage in the world on our advisory board" really boosts your credibility if your are focusing on a real estate opportunity. A second and equally important benefit of advisors is that they can quickly help you refine your business and product vision themselves and connect you to people they know who can do the same. You can also use advisors to add significant technology and startup experience and expertise to your team.

Funding Slide

And so we come to the ask slide. By now you should have clearly identified a large growing market, described (or launched) a competitive product that should be poised to dominate your market, and convinced the investor that you have what it takes to execute against your opportunity. In other words, you should have left them with an impression of huge upside potential with nominal market, product and execution risk.

Now it's time to ask for the money. I like to tie the ask back to the financial model on your Financials slide. In my example below, Gleamr is asking for the $2M they need to execute Year 1 of their financial plan. The plan identifies very clearly what traction (users, customers and revenue) the investor should expect and how much of their money Gleamr will allocate the investment across their various operations including Sales & Marketing, Customer Support and Product Development.

Summary Slide (Again)

Since you'll want to leave a slide up while you answer questions, I suggest you have a second copy of your Summary slide at hand to end on a high note.