If you’re an early-stage founder looking to raise capital from early-stage investors, particularly angel investors, then you’ve come to the right place. In this article, Mike Suprovici (Entrepreneur In Residence at Founder Institute and Graduate of our San Diego chapter), outlines the ins, outs, and best practices of startup fundraising.

Raising your first round of funding for a new founder is a daunting, frustrating, and extremely time consuming experience. You are searching for a needle in a haystack, while herding cats and blindfolded.

However, like any activity, you can master it and succeed. Below is an approach we have used to help hundreds of founders raise their first round of funding in the Founder Institute.

Preparing to Raise Funding

Before you even begin, you need the following:

-

A strong startup idea that is vetted and backed by solid market research. See this startup idea guide from the Founder Institute.

-

A prototype, a patent, or a proof of concept for the final idea.

-

A simple and scalable startup financial model that shows at least $10M in revenue after 3 years. See this revenue forecasting template from Aaron Patzer, Founder of Mint.com and FI Mentor.

-

A strong 10 to 15 page investor presentation. We will discuss this further below.

-

An incorporated entity with a smart capitalization table ("Cap table"). See this simple cap table from Venture Hacks.

-

The ability to quit your job and live for six months on savings while you conclude the financing and launch the business.

Set Your Expectations

Raising funding is HARD, even for the most experienced entrepreneurs.

You should assume the following scenarios will happen to you, whether they come true or not.

-

You will meet with well over one hundred people and pitch your business hundreds of times.

-

It will take over 20 hours per week for anywhere from three to nine months.

-

You will become frustrated many times and think about giving up. Perseverance is key.

Raising funding is like that Tom Cruise movie 'Edge of Tomorrow'. Every day you will die, and then you just need to wake up the next day, take what you learned, and try to get a little farther" - Scott Painter, FI Mentor and Founder of TrueCar and Fair.com

Self-Preparation

At the earliest stages, a huge part of the investor’s decision to invest is based on people, you and your startup team.

The key to securing an investor will center around :

- Your ability to network and develop relationships.

- Articulate a coherent vision for the business, and the potential for growth, that excites potential investors.

- Being extremely knowledgeable about your industry and knowing what it will take for you to succeed.

Your job is to make investors feel confident that your company is on track to success and that you’re the person to lead it.

Fundraising Materials

In order to go fundraising, you will need to prepare high quality, presentable, clean and clear fundraising materials, including:

-

A one-pager (AKA Executive Summary) that highlights key facts about your company which will be used to introduce you to potential investors. See this Startup Executive Summary Template from the Founder Institute.

-

The funding pitch deck (10-15 pages) that you will use when presenting to investors. See this Simple Template for Your First Pitch Deck, or this Compreshensive Startup Pitch Deck Template from the Founder Institute.

-

Backup slides to your pitch deck that contain more detail on your business (should the investors ask about those topics during your meetings)

-

A financial assumptions model showing how you are thinking through cash needs and your expectations for growth.

Advisory Board

Early on, an advisory board can help fill the expertise and knowledge gap in your team by providing relevant advice, making introductions, lending credibility and generally challenging assumptions to help you drive your company forward.

For help finding and securing advisors, check out the Founder/ Advisor Standard Template (FAST Agreement), from the Founder Institute.

Have your advisor(s) serve as your initial filter for feedback and insight as you prepare and iterate on your fundraising materials.

Recommended Reading: In addition to the links and templates above, check out the following:

- Startup Pitch Deck Guide, by FI Mentor Malcolm Lewis

-

A Look at Mint.com's Pre-Launch Pitch Deck, by Mint.com

-

Examples of Successful Startup Pitch Decks, by Picktochart

Setting Your Goals in Fundraising

The initial step in raising your first round is knowing exactly how much funding your company will need in order to achieve meaningful milestones for your company and your investors at specific points in your growth trajectory.

How Much Should You Raise?

In short, raise as much as you can. Your primary objective should be to adequately fund your company so that you have the necessary resources to reach the next set of significant milestones.

You’ll have to determine which milestones are the most meaningful to your company’s growth and potential investors at your stage. Remember, milestones are about moving your company from one stage of risk to the next. You will want to create a timeline of key milestones along with a cash milestones that includes an additional buffer to help you get through to the next fundraising event (usually 3-6 months).

Who Are Your Target Investors?

If you are raising your first round of funding, then you are likely still at a pre-angel or angel investment stage. As a result, you should immediately STOP trying to pitch venture capitalists.

Here are some guidelines on when and who to pitch:

-

Friends and Family: Always!

-

Angels: You pitch angel investors when you have a functioning prototype used by a small subset of the target market, at least one full-time person working on the business, and some validation for the business (which could be impressive data, your team, advisory board, etc).

-

Venture Capitalists: You pitch seed-stage venture capitalists after you have closed at least $500,000 in angel investment, you have a few people working on the business full-time, and you have a finished product that is gaining significant month-over-month market traction.

Don't Start Meeting Investors Until you are Ready

It's relatively easy to get meetings with venture capitalists, famous angels and seed-stage funds. However, once a professional investor looks at your deal and does not invest, you will rarely get a second chance and word will spread among other investors that you are weak.

Before you start meeting with investors, it is important to understand:

- Investors keep spreadsheets and notes on everyone they meet, even casual encounters or meetings at startup events. Many investors are processing between 2,000 and 4,000 opportunities per year, so information that you share with them today can hurt your chances with them in the future.

- Most local investors know one another because they co-invest in deals together (especially angel investors and micro-VC firms, whose individual investments will rarely represent an entire round).

- Once you start meeting with investors, you may start getting contacted by junior people at venture capital firms called "Associates" or "Analysts" that appear very interested to learn about your company. In reality, these people are doing diligence on investments in other businesses they are considering, and do not have real interest in your company. More often than not, meeting with these Associates will do more harm than good: by providing them with data on your company before you have great data to share, you can hurt your chances of investment from them in the future.

The Biggest Challenge: Finding your "Lead Investor"

The single goal of your fundraising efforts is to find a "lead investor."

You can find a lot of interested investors for a round, but you need to find one "lead" to get the round closed.

This individual or entity will set the terms and the price for an investment into your company that other investors "follow."

Why Investors Might Not Want to "Lead" a Deal

Leading a round comes with a lot of responsibility, but no extra financial reward (usually).

The lead investor sets the terms, bears various legal expenses to close the deal, does time consuming "due diligence" on the company, takes an unpaid advisory or Board of Director role, convinces other investors to join the round, and answers a lot of questions by other investors.

Worst of all, the lead normally gets the largest share of the headaches and blame if a company fails, but with all with the same economics as the "followers."

The Perfect Lead

The reality is that finding a lead boils down to an absolute confluence of circumstances. You need to find a person:

-

That is interested in your market segment.

-

That really likes your personally.

-

That can add some day-to-day value in scaling the operations.

Finding three out of three is only possible with either extreme luck or careful planning. Let’s look at some of the situations that creates a lead.

1. Interest in your Market Segment

The most common way to find "interested investors" is to go to industry and networking events where other people from your market segment will be. This process can start before you are formally fundraising.

Many of these events will have a price of admission, but if you believe there will be angels and professional investors interested in a market segment in attendance, then they are probably worth the price.

At these events, you should exchange contact information with as many people as possible, and get every business card that you can. Once you’ve collected a good number of business cards, follow this process:

-

Take all of your business cards and sort them.

-

Identify all the people that have either made investments before or have a lot of contacts in the industry, which you can check by looking at CrunchBase, Linkedin, AngelList, and Google.

-

Using this tracking sheet, mark the people that have made investments as a "1" (a high value target). Mark any classic connector, such as a banker, consultant, or lawyer as a "2," and then mark everyone else as a "3."

-

You should have at least 100 people on this list, so if you didn't meet enough people, search for other relevant and local angels by looking at the investors of similar businesses. Just make sure these targets are interested in your market segment.

The Media-based Strategy to Finding Investors

There is another, more challenging way to find investors that founders with great promotional and public relations skills can pull off. This is to make your market segment "hot" and then have the investors come to you.

If you take this approach, which is not possible with every segment, you should always be thinking about actions that you could take that will generate stories in the media. With this strategy, the media essentially becomes your fundraising tool, and you should spend more time getting to know bloggers and reporters than investors.

Recommended Reading: Check out the following resources on generating media.

- The Bootstrapper's Guide to Startup PR, by Founder Institute

- Write a Killer Startup Press Release in 7 Steps, by FI Mentor Conrad Egusa

- Best Practices for Pitching your Startup to Journalists and the Media, by FI Mentor Robin Wauters

2. A Good Relationship

Entrepreneurs "kiss a lot of frogs" before they find a lead investor.

As the one who needs money you obviously want to close the investment and get going, but most lead investors want to get to know you first. Given this dynamic, you want to maximize your facetime with people that are likely to be a lead investor or to know a lead investor, and you want to minimize your time with everyone else.

In fact, it’s not very important to identify and designate your "follow on" investors in the beginning, since you can’t close anything without a lead.

Once you have your industry target group, develop a regular, but not intrusive, follow-up strategy. This can consist of the following:

-

Your go-to-move should be to ask for advice, since most investors appreciate being asked for advice. For example, ask some of them to try out a new feature in your product.

-

Invite them out to have a beer or coffee. Seriously! This doesn’t have to be a formal request.

-

Ask for a recommendation on a business advisor.

- No matter what, find a way to engage with them at least once or twice per month.

DO NOT start by asking for investment.

Instead, build the relationship. There are a couple ways to broach the topic of needing investment without appearing desperate after a few business or social interactions and after a comfort level is established.

-

One way is to discuss expansion plans that you have, which often leads to the question, "how you are you planning to finance the expansion?"

-

Another more direct way is to ask, "do you know anyone who might be interested in investing in the business?"

Why Potential Investors Don’t Want to Lead (and how to fix it)

There are a lot of individuals that may be interested in investing in a round that do not want to lead a round. Why? Because there is time, money and headaches associated with leading a round, but rarely is there any economic benefit to being a lead. Let’s take a quick look at the challenges involved in leading a deal and some ways to overcome them.

1. They Don’t Have the Time

To lead a round, an investor must invest time to understand the company and the founders, which is referred to as due diligence. Professional investors complete formal due diligence by doing background checks, remodeling the financials and even checking source code. Angel investors tend to do more informal due diligence by speaking with customers, partners and team members.

The process can be time consuming, and there is no financial reward. As a result, it makes sense for you to offer lead investors a "Board of Directors" or an advisory board position with equity compensation ranging from 0.5% to 2.5% after they make an investment (as a way to make up for due diligence hassles). We reccommend you make these positions contingent on the round closing.

>>> SOLUTION: Just say, "we would like you to be a formal advisor or Board Member if you lead the round."

2. They Have to Cover Legal Expenses

An investor that decides to lead a round will most likely incur legal expenses related to drafting and reviewing proposed term sheets and other documents. These fees (which can be in the tens of thousands of dollars) usually will get deducted from the final investment, but since not all deals close the lead investor takes the risk of being stuck with the bill.

Companies can help to mitigate this risk by discussing the deal terms up front, and then having their company counsel develop the term sheet and closing documents, versus having the lead investor do the work. Then, the lead simply needs to review the documents and make changes, saving significant costs. Generally, it’s better to control the document drafting anyway.

>>> SOLUTION: Just say, "let’s discuss the terms that you would like to invest with, and we will be happy to have our counsel draft something for you to review."

3. Unspoken Responsibilities & Reputational Risk

The lead investor in a round generally has additional unspoken responsibilities and reputational risk. For example, the lead frequently recruits other investors and often gets called when something goes wrong with the company.

The best way to overcome the reputational risk is to be a "hot deal" that other investors are interested in. If a deal is seen as bad and fails, that looks bad for everyone. As a company, the best thing to do is strategically time media, buzz, the announcement of partnerships/ deals, news of a new team members, or other positive news in the period that the lead investor is making a final decision.

This "buzz" could even just be an email to the potential investors if there is no public news to announce.

>>> SOLUTION: Create buzz in the period that the lead investor is making their final decision, and if buzz is not available, just say, "we’ll work exceptionally hard to get other great investors and anyone that you recommend involved in the deal."

The Steps to Finding a "Lead Investor"

Finding a lead investor is much more time consuming than you expect. The best way to do this is as follows.

-

Complete your Target List with at least 200 angel investors that meet the criteria from the previous section. Use real-world events as well as research across CrunchBase, Linkedin, AngelList and other resources to build the list.

-

Add the investors from your Target List to a CRM such as Streak to track your interactions.

-

Set-up face-to-face meetings or calls with 25 target investors per week over a three to four week period, and leave time for follow-up meetings in this intensive outreach period.

-

Follow-up with genuinely interested investors using brief email communications to build interest and to plan additional face-to-face meetings. Document and ignore other more casual interest.

-

Establish a strategy to meet and engage with a high-probability lead candidate between five and seven times before asking the individual to lead.

-

Once you have a lead investor with mutually agreed investment terms, return to all other investors with either serious or casual interest and attempt to "circle" additional interest.

Closing the Deal

Once you have identified the lead investor, you need to "paper the deal" and "find follow-on investors." Let’s look at each.

Fundraising Documents and Legal

A typical investment will have a "term sheet" that outlines the various terms of the investment, following by "closing documents" that translate the abbreviated terms into final investment documents. The majority of deliberation and negotiation for early-stage deals is in the term sheet, so this will be the focus here.

There are two types of early-stage investments:

1. Equity

The simplest option for fast growing technology companies is to take a convertible debt financing, where an investor loans the company money that converts to equity in the next round of financing, usually at a discount to the purchase price for that equity.

Equity investments for early stage companies are more complicated and costly to close, since you need to adjust the capitalization table, set a purchase price and establish a more formal Board of Directors, among other things. The term sheets are between three and seven pages long, the closing documents will exceed 50 pages and the closing costs usually exceed $25,000 in most cases. The big decision is whether you are going to do a round that sells less complicated "common stock" or a more complicated round for "preferred equity." Since these financings are more complicated with a myriad of possible terms, we will not go into much detail.

2. Debt Convertible Vehicles

- Convertible debt term sheets are regularly one or two pages, and the closing agreements are seven to fifteen pages. They generally cost less than $15,000 in legal to close. Debt is the most senior security in a company, so the debt holder will take possession of a business if it runs out of money.

-

SAFE: SAFE that stands for “simple agreement for future equity”. Created by Y Combinator as a new financial instrument to simplify seed investment, SAFE is a warrant to purchase stock in a future priced round.

The best time for startups to raise debt are:

-

When the company is growing, but not fast enough to get a bunch of new equity investors interested

-

When unit economics actually work but there is a valuation gap or management does not want to be diluted further

-

When the company is close to profitable and equity is too expensive or will take too long to raise

-

The company is more than ten years old and equity investors are tapped out in their older funds.

There are three key negotiating areas of a "convertible deal”:

-

The price. The major negotiating point will be the price, and generally speaking you should be willing to accept any reasonable offer that sells less than 40% of your company after closing.

-

The term before conversion if there is no further financing. Generally speaking, the term is normally 18 to 24 months.

-

The type of stock. As a rule of thumb, for "friends and family" seed rounds or basic angel rounds with less than $500,000 to $750,000 invested, you should try to negotiate a deal for common stock to save money and time. The problem with selling preferred stock in an early investment is that you will then issue you first "series" of security, normally a "Series A," and there is a stigma on having too many series of stock, such as a "Series E." Companies should look to reserve the Series A for a professional venture investor.

-

The minimum amount to close and the maximum amount allowed. The ideal minimum is the amount that the lead investor is contributing, somewhere between $50,000 and $250,000. The ideal maximum is probably between $500,000 and $750,000. You may also want to specify the minimum amount that each individual investor must contribute, which is normally $25,000 but will obviously be higher with a larger round.

-

The discount into the next round, and the dividend. A standard discount is 25%, and the dividend can be between 6% and 10%.

Recommended Reading: Check out the following resources for fundraising documents and legal.

- The Ultimate Guide to Understanding Convertible Debt, by LawTrades

- How to Read a Convertible Debt Term Sheet, by Hyde Park Angels

- Cap Table Template, by VentureHacks

- Equity Fingerprint Guide, by EquityFingerprint

- SAFE Template (Simple Agreement for Future Equity), by Y Combinator

- Important Things to Understand about SAFE Agreements, by Wilmer Hale

Find Follow-On Investors

Angel investors will often express "interest" in a deal as part of an effort to gain more information. When fundraising with angels and other investors, you will "soft circle" investment amounts from interested and less serious investors, and you will "hard circle" investment amounts from committed and more certain investors.

As a rule of thumb, less than 50% of money that you soft circle will close, and about 75% of money that is hard circled will close. As you convince investors that your deal is more and more appealing, you will move the investor from "soft circled" to "hard circled."

Here is an Example Timeline of Events:

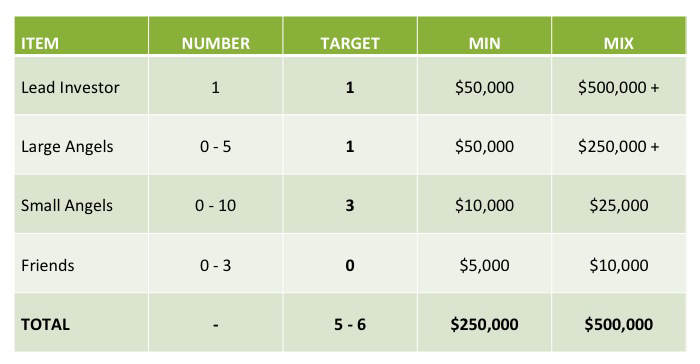

- A typical angel round for $500,000 will have one lead investor for approximately $100,000 or $150,000, two or three $50,000 investors, and six to ten $25,000 investors.

- You are looking at a minimum of 8 investors and as many as 20 to complete a meaningful round, so you will need to soft circle 40 or 50 investors.

- You will likely pitch three times the number of investors than you soft circle, and, in the current market, you should expect to pitch 150 investors or more.

- Generally speaking, you will target a minimum of 5 angels investors for any round of $250,000 to $750,000. For smaller rounds, the lead may only need to invest $25,000 or $50,000. You can continue to recruit investors until the time period of the round ends or the round hits the maximum close amount.

The good news is that a lot of angel investors will express genuine interest in a deal, making both soft and hard commitments. A quick and vague commitment is actually a common tactic by angel investors to gain more information and to evaluate the working relationship.

As a Founder, you need to manage the process and create a sense of urgency. The best way to encourage follow-on investors to participate is to have agreed upon terms with the lead investor and a set closing date. A typical angel round will have a "first closing" and a "second closing." Some rounds even support a "rolling close," though this does not provide a sense of urgency. The purpose of a closing is to ensure that all of the paperwork is completed properly by all of the involved parties.

There are three ways to identify the follow-on investors:

-

As you are seeking a lead investor, you should identify everyone that might be interested in an investment. Keep everyone in your target group.

-

Go to angel networks and angel groups AFTER you have identified a lead and papered the terms. The groups are significantly more responsive when there is a concrete opportunity.

-

Ask the lead to provide a specific number of potential follow-on investors. You can ask, "we are looking to secure another $250,000, can you recommend five people that might be interested in the opportunity?"

Final Thoughts

Any successful founder is always raising money. The challenge is to start a formal process to raise capital from a position of strength, versus a position of weakness. Here are some closing tips that will prove very useful.

The goal of every investor meeting is to get to the next meeting.

The odds of closing an investor increases geometrically with each phone call or face-to-face meeting. Say or write as little as possible to encourage curiosity and get to another phone call or meeting. Sending a long email with many files is the wrong approach. Over informing in the beginning makes it easy for an investor to say "no."

Don’t ask for an investment if the answer is a likely to be "no."

Out of frustration or desperation, many founders push investors to make an investment decision prematurely, and the investors generally say, "no." Angels invest their own money, so saying, "no," is very easy for them. Wait until you are confident that the investor will say, "maybe" or "yes," before you ask.

Be conscious of mistakes and refine your pitch constantly.

Most investors have no incentive to openly explain mistakes that you make pitching, so you need to carefully observe body language and behavior during your presentation to identify when you make a mistake. Have a piece of paper out and write down what you were saying or showing when you notice bad signs. After you finish your pitch, be sure to ask, "how might I improve my pitch?" Expect to update your presentation with each pitch. It can be dangerous to refine the core idea based on feedback. Start by refining weak areas of the pitch.