As the hidden potential of blockchain continues to be explored, what we’re discovering is its benefits to help startups, especially when it comes to finance. For most, if not all, small businesses, access to financial services is highly restrictive, proving to be one of the biggest detriments to further growth.

However, in this syndicated blog post, Russ Malangen of Acudeen (a Graduate company of the Founder Institute) outlines how blockchain can help new companies to thrive in the global economy.

The article, “How Blockchain Technology Can Become The Catalyst For Global Financial Inclusion - An In-Depth Analysis of The ACU Token”, originally appeared on Medium, and has been republished below with permission.

Providing access to financing is a tall order — both on a regional and global macro perspective. From regulatory hurdles to bureaucratic roadblocks, there are very limited options for the average citizen to access available funds without going through long and arduous processes. In many parts of the world, strict policies and the delay in releasing money to SMEs with exorbitant interest rates are simply killing off any chances of small businesses surviving lest they have their own abundance of wealth to manage their resources.

While there has been progress toward financial inclusion, significant challenges remain. Below is an excerpt from The World Bank:

More than 200 million formal and informal micro, small and medium-sized enterprises (MSMEs) in emerging economies lack adequate financing to thrive and grow. MSMEs cite a lack of collateral and credit history, and business informality as main reasons for not having an account.

In other words, small business owners struggle to grow and keep afloat because of the lack of financial resources available on-the-go. On a wider outlook on things, there is a definite opportunity to bring together various solutions in place and innovate based on the results produced so far.

The Current Solution: Enabling SMEs

Acudeen Technologies was founded in 2016 with the idea of bridging the gap between small enterprise owners and proper financing through an inclusive digital platform. The premise is simple: Sellers may upload their invoices to the marketplace and have the option of selling this receivable account via auction to:

a. Financial Institution Partners (Banks)

b. Qualified Funders/Individuals

Once a purchase order has been accepted, Acudeen validates the authenticity of the both the seller’s invoice and the funder’s purchasing capacity. Acudeen then selects a date in which they could execute their transaction. Within 7 days, businesses will be able to liquidate these receivables ahead of their maturity date, therefore allowing them to use the said funds for more mobility, optimizing their cash flow. A trust account owned by the company essentially enables Acudeen to act as the escrow for invoice payments until it is ensured that the transaction is valid and safe for both consumers.

“Since we partnered with Acudeen, the challenges of waiting at least 60–120 days that we experienced before are long gone. It only takes us 3–4 days to get our receivables now. And the good thing about this is we do not have to keep following up the payments with our clients, instead Acudeen will do that for us.”— Ryan De Jesus, Value Printing Solutions

This model has proven to be a successful one, as they have managed to facilitate over $2.4 Million worth of invoices to date, won multiple awards and earned recognition worldwide within the short time span that the company has been operating. However, the team envisions the company’s impact to be much bigger for the next few years.

Join us as we feature Acudeen in our upcoming webinar, "Blockchain For Global Financial Inclusion".

A Step Further: Entering The Blockchain Revolution

Let’s dig deeper into things. While there has been a good amount of success attained with the current model, there are still a few facets that could be improved, such as:

- Removing the need for manual validation by a third party (Acudeen)

- Transparency in transactions occuring

- Identifying Fake/Fraudulent Invoices

- Cumbersome monetary disbursement process

The fundamental question asked for any application, of course, is “Why Blockchain?” and rightly so.

- Decentralization allows Acudeen to directly integrate different actors into the existing ecosystem

- The authenticity of movable assets are ensured

- Transfer of invoice ownership is permanently recorded and verifiable

- Users with consistency in transactions and good standing may be incentivized

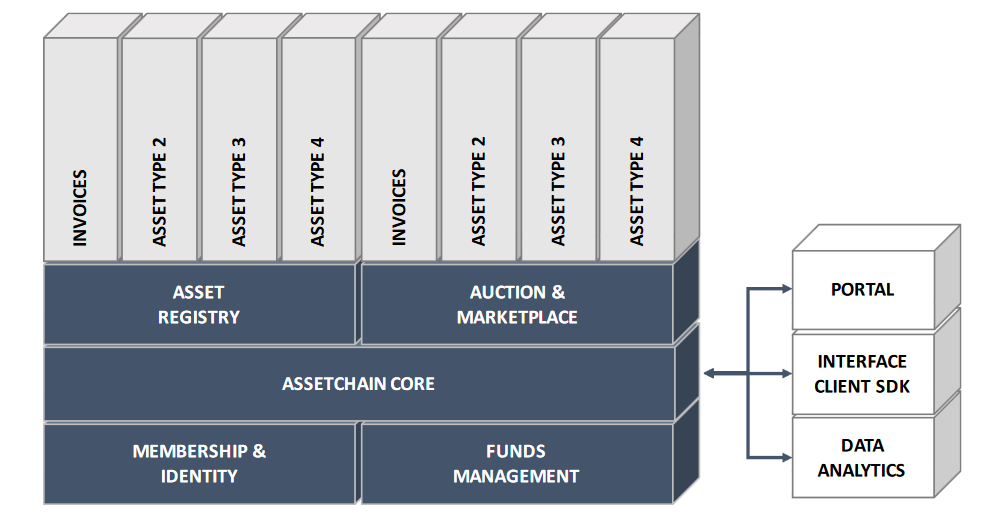

FIGURE 1: Blockchain Ecosystem Framework

With this in mind, the team developed an inclusive blockchain-based ecosystem with three main drivers as its operating mechanism, The AssetChain, The ACU Token and CryptoFIAT. Together, these three foundational technologies will help revolutionize the way Acudeen enables small businesses to thrive in the global economy. By making transactions more hands-on, there is more incentive for users to participate as they are in control.

Framework: Hyperledger Fabric

FIGURE 2: Components of the AssetChain Platform (ACP)

The AssetChain Core serves as the ledger in which data could be accessed through a permissioned blockchain. A system with this setup ensures that sensitive information for businesses are kept confidential and shared only to the parties involved. Essentially, access to certain bits of information may be restricted by the providers of the private key for various reasons. Their account on the AssetChain will contain all their previous transaction records, business partners and other relevant authenticity parameters. This technology is made possible using the Hyperledger fabric. (See image above)

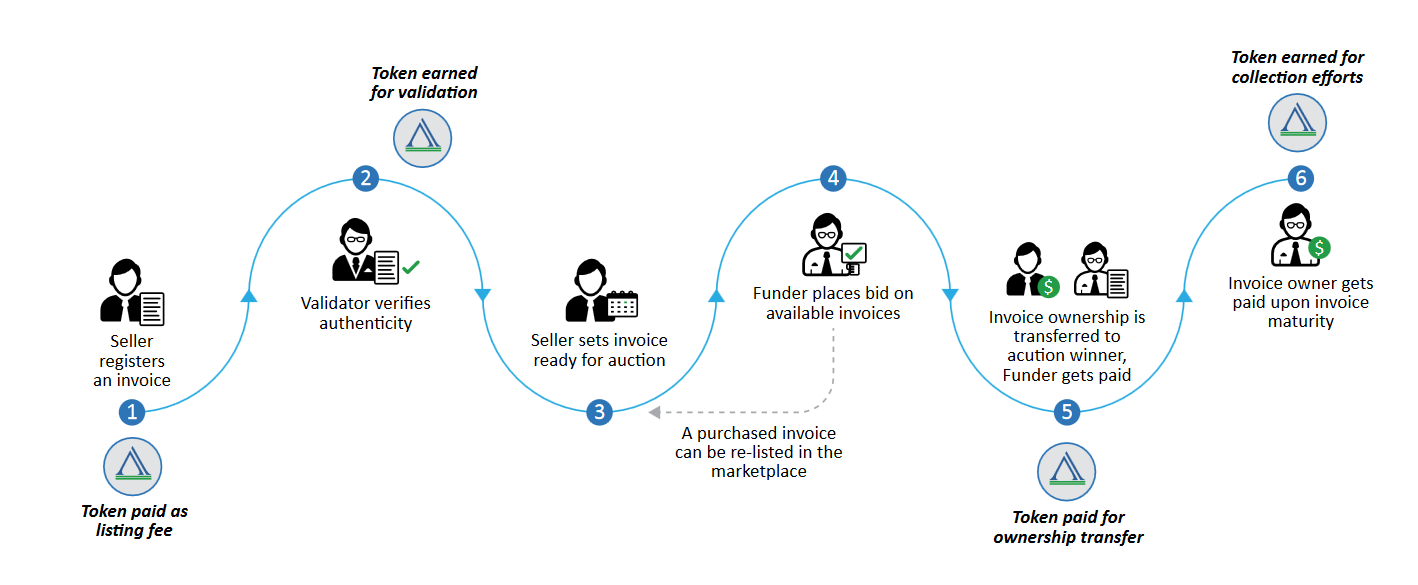

Stellar Protocol: ACU Token

FIGURE 3: An Illustration of ACU Token Usage

FIGURE 3: An Illustration of ACU Token Usage

ACU is the utility token for the new framework which is applied to the Stellar protocol. It’s beneficial for the AssetChain’s framework to run on such because it enables anyone around the world to transact and remit at a fraction of the time and costs that it usually takes to do so.

As illustrated above, the ACU token drives the ecosystem by being used to pay for services within the AssetChain. The data is then logged on to the blockchain and may be used as reference. Furthermore, this allows Acudeen to identify user integrity based on their actions, enabling them to penalize/incentivize certain users. This also makes it easier to catch suspicious or fraudulent activity on the system.

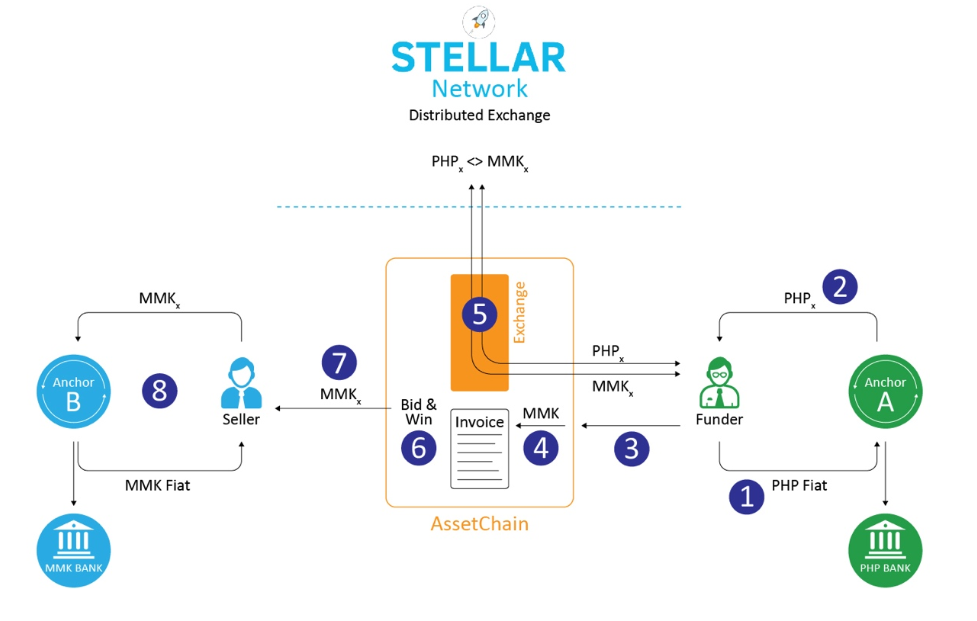

Cross-Border Invoice Purchasing: CryptoFIAT

This is where it gets really interesting. The third aspect of the ecosystem is called CryptoFIAT. In essence, this is the stable token backed by a fiat currency that will be used to enable cross-border movable asset purchasing. Now there’s no need to convert Currency A to USD in order to remit payments by converting the USD to Currency B. CryptoFIAT directly associates the coin’s value with its fiat equivalent, eliminating the need to undergo a tedious and expensive process.

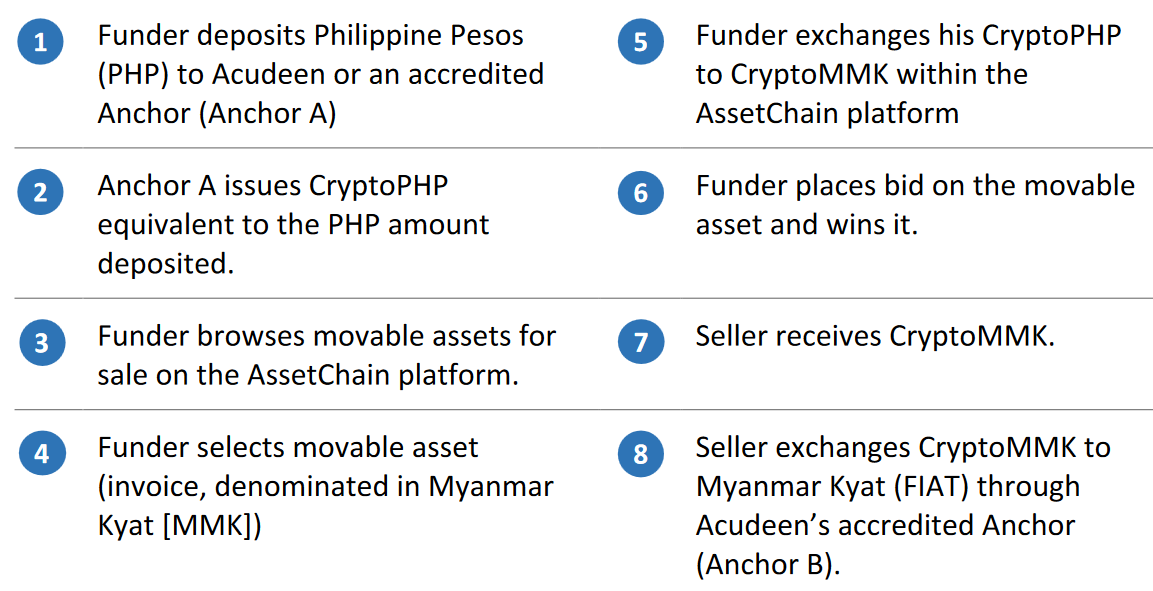

FIGURE 4.1: The Process of Using CryptoFIAT Explained (Example)

It’s understood that at this point in time, fiat money is still considered the standard and is widely used in business transactions. In order to lower transaction fees when going worldwide, cryptocurrencies are used to remove any intermediary parties. However, the value of these coins are extremely volatile and vary from day-to-day which makes them unfit for store-of-value. By leveraging the AssetChain, the CryptoFIAT effectively ties its value to the fiat currencies that Stellar anchors will be holding, allowing users to purchase invoices with crypto tied to real money value on the date of execution.

The Benefit for SMEs and MSMes

FIGURE 5: The composition of enterprises in Southeast Asia

The limitation of the Acudeen platform is that businesses are only allowed to upload receivables. By using the Blockchain, it will be possible to track and facilitate transactions with other movable assets such as inventory, trademark, warehouse receipts, physical products and the like. The graph above illustrates just how much of the market remains untouched by the current system.

Without this piece of technology being utilized, it will be challenging to tap micro businesses which comprises over 80% of the current market. Over the next two years, Acudeen will be in the position to own over a quarter of the total addressable market (TAM) for SME receivables (excluding micro enterprises). Thus, it only seems fitting that there is a working infrastructure in place to be able to properly manage these alternative forms of movable assets, further giving them flexibility and mobility to grow their businesses.

Conclusion: Blockchain For Global Financial Inclusion IS The Future

By using a proven model of a hybrid buyer and supplier-led financing system and improving on it by way of adopting new technology, the outlook on financial inclusion with Acudeen’s project is highly encouraging. Blockchain technology has had numerous use cases over the past year and has soared in popularity as a result, albeit only very few actually leverage its potential for something equally as disruptive as changing the fintech industry overall.

By using a proven model of a hybrid buyer and supplier-led financing system and improving on it by way of adopting new technology, the outlook on financial inclusion with Acudeen’s project is highly encouraging. Blockchain technology has had numerous use cases over the past year and has soared in popularity as a result, albeit only very few actually leverage its potential for something equally as disruptive as changing the fintech industry overall.

To recap, the benefits of tokenizing existing services include:

- Expansion into other markets who are also in need of financial enablers

- Security for Business Owners’ Data using a Permissioned Blockchain designed with Hyperledger

- Incentive/Penalty System based on User Integrity based on ACU Token Logs

- Ability to use CryptoFIAT to purchase invoices across different countries without having to convert to USD in banks as an intermediary, thereby incurring less costs and having significantly faster transaction times

- Micro Enterprises can utilize the platform because of Blockchain Technology

The potential for such an innovative and dynamic framework makes room not only for Acudeen, but for other players in the space to collaborate in solving the problem of providing access to funds to MSMEs and SMEs, allowing them to thrive and contribute to their growing economies.