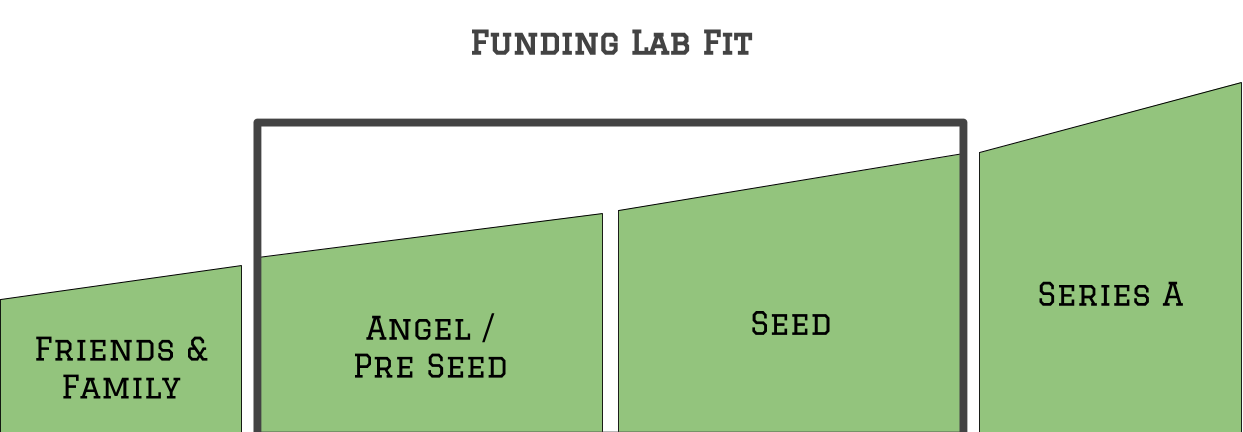

The deadline for Founder Institute portfolio Alumni to apply to join the next Funding Lab program cohort in Q3 2023 is August 6th—get your applications in now. Funding Lab is a dedicated 10 week post-program exclusively for Founder Institute alumni, designed to help accelerate the close of their first institutional fundraising round.

The program is similar to the Founder Institute core accelerator, and requires a similar level of intensity—there is no additional cost to Alumni to participate.

Founder Institute’s dedicated Alumni Success team works closely with our portfolio companies across the globe to help 100+ startups raise funding from angel investors each year, via the flagship Funding Lab program.

If you are a Founder Institute Alumni interested in applying, please complete the internal application here.

Benefits of Funding Lab include:

- Structured Program focused solely on fundraising

- Global program with Virtual Setup so any FI Alumni can participate

- Execution-focused Curriculum that is results-oriented

- Sensitive to Founders’ Time so that they can continue to scale

- Weekly Deliverables that apply directly to driving real world results

- Dedicated Office Hour Sessions with Alumni Success team

- Progress Reviews at 7 weeks to create accountability

- Term Sheet Support so all founders can feel comfortable with raising

However, in order to be considered for Funding Lab, portfolio Alumni must meet the following minimum criteria:

- The Founder(s) must be working exclusively on their FI company

- The company needs to have a functioning product (“Beta” version, at a minimum)

- The company needs demonstrable customer demand or traction

- Be willing to spend 25+ hours / week for the next 3+ months to raise funding

- Your team has to be two people or more, including yourself

You can learn more and get answers to common questions on the Funding Lab FAQs page.

Through the Funding Lab program and with the support of FI’s dedicated Alumni Success team, portfolio Alumni of the Founder Institute around the world have collectively raised more than $1.75 Billion in funding to date, including from leading venture capital firms like First Round, Javelin Venture Partners, Andreessen Horowitz, Sequoia, and many more.

A small sampling of recent Funding Lab success stories include the following Alumni:

- Subly (London) - raised $1M Seed in Funding Lab

- Spotivity (Chicago) - raised $1M Seed ($350k closed in Funding Lab)

- Endiatx (Silicon Valley) - raised Pre-Seed Funding

- HOHM (San Diego) - raised Pre-Seed Funding

- Fairly AI (Waterloo, CA) - raised Pre-Seed Funding

- PaintJet (Silicon Valley) - raised Pre-Seed Funding

A handful of other notable Funding Lab program Alumni that have gone on to raise substantial further / additional funding rounds, post-participation in Funding Lab for their earlier seed/pre-seed rounds, include:

- FightCamp (Montreal) - raised $90M Series B

- Unito (Montreal) - raised $10.5M Series A

- Involve AI (San Diego) - raised $2.5M Seed

For a sample of the Funding Lab program, check out this list of ‘Fundraising Basics’ taken from the Funding Lab pre-curriculum, which outlines some of the key do’s and don’ts for pre-seed and seed-stage funding:

- Timing

We consistently see founders who start raising with no team or traction, which ultimately leads to failure. If you are not ready, but still need funds to continue building your business, consider applying for non-dilutive grants or raise a Friends and Family round. - Create a Target List

To be successful in early stage fundraising, you need to create a target list of 150+ investors that invest in startups at your stage, industry and region. Successful pre-sed founders can pitch up to 100 investors, and will tend to avoid the big-name VC funds such as Sequoia, A16z etc. - Focus on Angel Investors

Angel investors and High-Net-Worth individuals are the best source of capital for pre-seed and seed-stage founders. They have lower expectations for traction compared to funds and take a lot less time to make an investment decision, which helps you improve significantly on ROI for time spent fundraising. - Don’t Pitch Too Early

Avoid pitching professional investors without having the proper preparation, materials and strategy. You tend to have only one shot with investors, because once they say no, it is usually a no forever. Burning through your entire network can hurt your ability to fundraise in the future, and your highest-value targets should be pitched only towards the end of your round. - 25 Hours / Week Commitment

Fundraising is basically a full-time commitment. You need to be prepared to allocate 25h+ a week minimum on fundraising, for 3 months or more, and dedicate part of your day-to-day CEO responsibilities to your trusted team members. - Use Warm Introductions

Always leverage warm introductions from connectors to get to your investor targets. Professional investors will judge your hustle based on the way you got to them—fair or not, that is just the way it is for most professional investors. - Regular Updates

At the beginning of your fundraising campaign create a newsletter and update all interested investors on your progress. To get started, you can use FI’s Investor Updates Template: fi.co/investor-update - NEVER work with Broker Dealers

Many parties will contact you and propose to raise for your startup in exchange for a fee or equity. NEVER work with brokers to avoid fraud and investor misalignment risks! Bringing the wrong people on your cap table can severely handicap your ability to grow the business. - Get a Fundraising Advisor

Bring on a fundraising advisor, preferably a successful entrepreneur that has recently raised money. Make the professional relationship with the advisor official using the FAST Agreement. Don’t hire investors as advisors who are not investing in your business. Get the FAST Agreement Template here: fi.co/fast - Create a Data Room

Have all your Due-Diligence documentation that is prepared for fundraising, lined up in a Data Room. FI Alumni can access the Data Room Guide here (must be logged into the FI site). fi.co/guides/1491 - Don’t Waste Time

You will engage with multiple parties that have expressed interest to learn more about the business, but would not invest. Common examples include VC associates and inexperienced angel investors. Most investors will say things like “You're too early” or “Call us when you have X.” Their goal with these statements is to leave their door open—but this is basically a No. Do not spend time and efforts on investors that drag the deal, and instead just continue onto your next lead.

If you are interested in applying, please complete the application here.

Graduates of the Founder Institute are creating some of the world's fastest growing startups, having raised over 2BN in funding, and building products people love across over 200 cities worldwide.

See the most recent news from our Grads at FI.co/news, or learn more about their stories at FI.co/journey.