Pitching your startup is both an art and a science: not only must it be tastefully presented, but it needs a structure that addresses the important aspects of your offering. However, with the multitude of resources available, it can be difficult to determine just what your startup pitch needs.

To remedy this, we’ve compiled four secrets for a perfect startup pitch from top Silicon Valley entrepreneur and investor Aaron Patzer, backed up by insights from entrepreneurial experts.

For those not familiar with Aaron Patzer, he is the founder and former CEO of Mint.com, a free web-based personal financial management service, that was sold to Intuit in 2009 for an impressive $170 million. He has invested in numerous startups, including Layer, DoubleDutch, and Prism Skylabs, among others, and is currently the founder and CEO of Fountain, an app that provides advice from a curated set of experts. Aaron is also one of the Founder Institute's highest rated Mentors.

1. Does it solve a real problem?

According to Aaron Patzer, the first criterion of a successful pitch is that it must address a real problem. While this may seem like a no-brainer, too many entrepreneurs focus on the solution to a problem and work their way backwards, when they should instead focus on a problem and work their way forwards.

In the Next Web article, “Dave McClure’s 10 tips for the perfect investment pitch”, Paul Sawers outlines entrepreneur and angel investor Dave McClure’s advice for pitching to VCs, emphasizing the need for founders to clearly define the problem their idea solves in their pitch.

I recommend that you talk more about what the problem is. This helps you establish an emotional context with the person listening.

But what if the startup idea you pitch doesn’t address a specific problem? Founder Institute Mentor Dave Parker discusses how founders can learn to identify problems in their target market in his blog post, “Have An Acute Focus On The Problem, Not the Solution.”

I worked on a technical hardware product some years ago. The company had spent a great deal of time and engineering building a hardware device for IT Security. The problem was that they had never clearly identified a (large) target market, or an initial launch market. They started with the solution then asked me to work backward to find the problem that the product could solve. Regretfully, it’s not that simple.

However, Parker goes on to explain how entrepreneurs can avoid this obstacle by providing two important questions to keep in mind when developing a startup idea.

1. What problem are you solving and for whom?

Evaluate your target market and your client profile, then determine if your potential customer base is expansive enough to justify building your product.

2. What is the Solution?

If you are a proponent of the Lean Startup Methodology, then you probably already know that you must identify your minimum viable product (MVP) before you build it. Justin Wilcox, another Founder Institute Mentor, even recommends that founders should start by testing the riskiest assumption about their product before identifying their MVP.

Remember, when pitching your company to anyone - including investors, customers, and industry experts - be sure to clearly define what gap your offering fills, what problem your product solves if you want to entice your audience.

2. Does it solve it in a big market?

According to Aaron Patzer, understanding your market is a crucial part of startup success. Without the proper market research, your brilliant startup idea may never be taken seriously and won’t capture the attention of customers, partners, and investors.

If you’re going to provide a product or service in any market, the first thing you should do is become an expert in your respective market. This will build your credibility as an entrepreneur and allow give you a clear vision for your company. Being an expert may include working in the market, experiencing the problem firsthand, and, of course, conducting extensive market research.

Market research will help you discover strengths, weaknesses, opportunities, and obstacles in your market. Good research will give you an idea of your market size, customer needs, and whether or not your business idea even makes sense. If you’re going to devote years of your life to an idea, the market you operate in must be big enough or growing at a fast rate to support justify your product.

Aaron Patzer provides several questions founders should ask themselves before executing their startup idea:

Are there any technological or market barriers to entry? Are there bigger markets for your product/service? How do you handle logistics of the market by balancing supply and demand?

Remember, building a product or service for a large market is important when pitching to investors, as they will only invest in companies that have high growth potential. However, don’t make the common mistake of exaggerating the size of your market; investors will question your sense of realism. Instead, clearly define your offering’s industry, then break it down into sub-segments within that industry.

Another mistake to avoid when pitching your company is loosely defining your market, so be sure to refrain from giving investors “conservative estimates” - this will only reveal your lack of expertise in your market.

Every market has a competitor, even if you think you’re the first at providing a certain solution to a problem. Investors want to know the market share on each of the big players within your market and how much you intend to acquire as well. If you don’t know how big the largest player in your segment is that’s not a good sign.

3. Is it something that has a competitive or sustainable advantage?

What makes your product one-of-a-kind? What edge do you have over your competitors, and why are you the perfect founder to deliver? Answering these questions will bring you closer to defining your competitive or sustainable advantage, commonly referred to as “secret sauce” - the one unique aspect that sets your company apart, if not above, your competition. Let’s outline it’s meaning:

-

“Sustainable” is defined by Dictionary.com as “a system that maintains its own viability by using techniques that allow for continual reuse.” Will your customers continue to use your product for a long period of time or will the novelty of your product dwindle before it catches on with a wider audience? You must prove to investors that you have well-established a system that is prone for long-term continual adoption.

-

“Competitive” refers to how your brand matches up against companies that may be addressing the same problem, but with an alternative approach. Investors are eager to learn about your competitors and market, so identify the brands you’re competing against in your industry and compare your strengths against competitor weaknesses. Think broadly, and leave no stone left unturned when evaluating your market.

-

“Advantage” is a measurement that needs to be significant and if possible, unparalleled. What makes your product favorable to success, superiority, and profit? Prove that your product isn’t easily duplicable or surpassable by your competitors. You as a founder may also be the advantage. Why are you the one to solve this problem? Don’t bore investors with your credentials or your passion; establish an emotional connection with your audience and share stories of past experiences or lessons learned.

Martin Zwilling, CEO & Founder of Startup Professionals, Inc., discusses the matter of identifying a competitive advantage for your startup in the blog post, “6 Key Drivers To a Long-Term Competitive Advantage”. According to Martin,

A sustainable competitive advantage requires value-creating products, processes, and services that cannot be matched by competitors now, and plan content to maintain that position as you scale. Of course all of this assumes you are in a big growing market, with adequate resources, marketing, and great people to deliver. No one said it would be easy!

When pitching your startup idea to anyone, keep in mind that highlighting the features that make your company stand out from your competitors will leave a lasting impression on your audience.

4. Can you make money or make a profit?

As Aaron Patzer states, startup ideas need to have the revenue potential to be able to make money. If your company follows the previous rules about solving a real problem in a large market, then you likely have a product that your customers will use and pay for.

The best way to show this in your pitch is to use any metrics that you may already have. If you have any paying customers, or even free users, this will speak volumes compared to other techniques. Remember, traction speaks louder than words.

If you don’t have any notable customers, or if your product has not yet been built, one of the next best tactics you can employ is to share your results of any customer development that you’ve done. For example, if you were to state in your pitch that “80% of the 300 customers that you interviewed said that they would pay for your solution to [problem]”, it would illustrate that your market is hungry for a product like yours. Or, if you are a user-based company, highlight how many users have signed up to get updates on your product to demonstrate the customer demand for your offering.

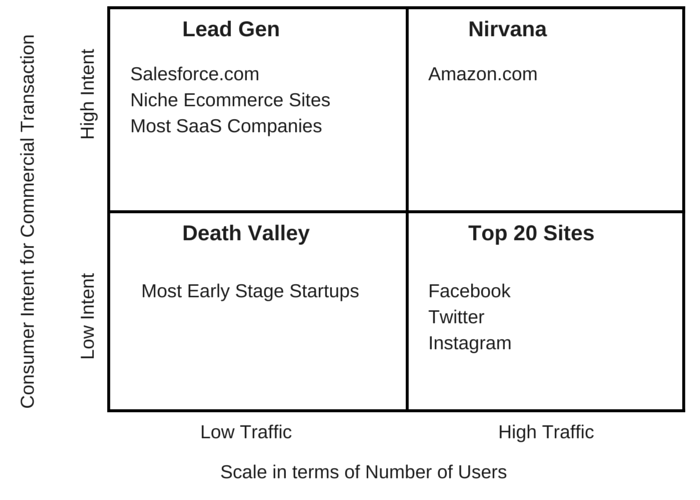

Gauge your product’s revenue potential by first defining whether you will be using a symmetric or an asymmetric business model. This blog post, “Before You Create Your Product, Create Your Value Proposition”, illustrates how to target your customers and the difference between the two models in depth, but for quick reference here are the definitions.

Symmetric - Your users pay for your product directly. Example: salesforce.com

Asymmetric - Your main users use your product for free, and someone else pays. Example: Facebook’s ad model.

If you have a symmetric model, make sure you are targeting a customer with a high intention to buy. Conducting market research will reveal how much money your potential customers spend yearly on products similar to yours. If you are using an asymmetric model, target a large enough market as covered in this post.

Research your market to determine your actual revenue potential and estimate your costs of operation. The blog post, “The Basic Components of Your Startup Financial Model,” explains how to create a financial model to forecast the revenue potential of your company. Use this as a tool when you pitch to prove that your company has the ability to generate enough revenue to sustain itself and produce a good ROI.

Conclusion

If you take nothing else from this blog post about pitching your startup, at least take these words of wisdom from Founder Institute founder and CEO, Adeo Ressi:

Make me BELIEVE by showing me you know what you’re talking about.

Do you want even more expert startup help? The Founder Institute is looking for aspiring entrepreneurs. Apply today!

Copyright: Image by StockUnlimited